2021 has been my third year since I took that initial leap into the FIRE unknown and for me it’s been my biggest year ever for change. Some good and some not so good. So with the sun fast setting on 2021 I thought it was time to take stock and write some of this down. Warning: If you don’t like blog posts that jump around this one may not be for you but if you want to know what FIRE can truly do to a person then I hope you find it helpful.

COVID-19

One of the 2021 elephants in the (influencing my life) room has of course been COVID-19. What I’ve found interesting is that it’s not the virus itself giving me mortality concerns. After all I’m a late 40’s healthy person who drinks very little, eats nutritious food, now has little to no stress, exercises regularly and doesn’t smoke or party hard so that part of life will probably turn out ok if it happens.

What I have however started to become concerned about is watching what a mix of a virus + power + politics + money + mainstream media selling fear + no real debate let alone scientific debate can turn the world into.

For example here in Australia I watched many Victorians being coerced into vaccination not because they thought it was the right thing to do for their and their fellow citizens health but because without it they’d lose their jobs and ability to feed their families. Coercion is never right in my books.

Another example is that I am truly shocked at what seems to be going on in Austria where very soon if you are an honest law-abiding citizen who just wants to live in peace you will soon find yourself having committed a crime punishable by large fines or imprisonment. It really does feel like we’ve regressed as a society significantly.

My COVID-19 coping mechanism is to minimise my contact with those selling fear, notably the ‘news’, which has resulted in a significant improvement in my wellbeing.

Housing

Housing has been a big topic for us this year. Firstly, let’s cover our current living arrangements. We are still renting in a beautiful part of the world close to the ocean (including visible sea life and plenty of water sports) and forests (including up close wildlife like kangaroos and plenty of trails) which we are absolutely loving. We’ve invested in some new bicycles and are really racking the miles up. So far so good.

While the above sounds idyllic, and it is for our rental situation, we’ve come to the conclusion that it is however probably not the place to invest hundreds of thousands of dollars, particularly if one believes in global warming. Why do I say this? Helpfully, the local Councils here in Australia publish ‘mapping’ for each of their regions which is really helpful. It enables you to overlay your home and various ‘events’. Doing this to our rental shows up an area susceptible to flooding and storm surges as well as being in a bushfire impact zone. On top of this our rental is made of wood and Australia seems to be full of creatures called termites that seems to love devouring wood.

So we rent in a beautiful part of the world but it’s not a part of the world where we’d ever own. Lots and lots of learnings on this front over 2021.

In parallel to us enjoying our environment as we closed on 2020 and entered 2021 a number of things occurred enabling the next part of our housing story to unfold. Firstly, we settled really quickly here in Australia and secondly, we started to really feel like Australia could be our home. We also saw interest rates on the floor and governments throwing taxpayers money at housing. We therefore decided to not wait for a year before deciding whether to buy or not but instead to start looking for a home immediately.

Initially, we started looking at existing homes that were either move in ready or that could be sorted with some advanced DIY and a few skilled trades. What we found though was a housing stock that just didn’t do it for us at a bare bones level. The construction technique seems to mostly be some pine sticks are erected, which are then wrapped in what looks like aluminium foil which is then covered with a single layer of bricks or cladding on the outside and some sheet rock on the inside. Insulation, what insulation…

So we went a different way and moved onto viewing empty plots of land. For a vast country I was genuinely surprised at how little land there was out there that would suit our needs. However, after a long time looking and literally thousands of kilometres on the road we found it.

What makes our land so special for us? Here we go:

- It’s big enough for us to grow some vegetables, fruit trees and develop some plantings that will make for a wonderful living environment but it’s not so big that it will turn into a full-time job.

- It’s walking distance to all the facilities one could need in day-to-day life.

- It’s walking distance to the sea but because it’s an elevated aspect it carries no flood or storm surge risks.

- It’s walking distance to forests full of wildlife but just far enough away that we don’t have to give any consideration to Bushfire Attack Levels (BAL)

We’ll still keep a car but I expect it will get very limited use.

With the land in hand our focus has now moved onto what home will we build. Our plans are currently in final revision with this being the gist:

- Small in size by Australian standards but more than adequate for our long-term needs.

- Steel frame! Remember those termites I mentioned.

- All walls insulated both thermally and acoustically.

- A metal roof that I expect won’t need maintenance until long after I leave this earth. Immediately, under that roof is an anticon blanket for both noise (think heavy rain on a metal roof) and thermal insulation. Additionally, we have thermal insulation between the living and roof spaces.

- A beautiful outdoor kitchen area where I expect many an afternoon will be spent barbecuing with friends.

- A large garage. The sun here seems to destroy everything and if the sun doesn’t do it the hail stones will! We have enough garage space for a car and my hobbies.

- A heat pump hot water system.

- Enough solar photovoltaic panels to cover our modest needs and give a bit back to the grid. At this point we’ve opted to not install batteries and grid tie ourselves as the land development enables trivial mains power connection. We’ll then see how it goes.

- We seriously considered a large water tank but knowing our garden will be very drought tolerant and knowing our home water usage patterns we just couldn’t make it work financially at this point. We have plenty of space for a tank so we’ll see how that one goes as well.

There is still quite a lot of house logistics to work through before we commence construction but 2022 is going to be a very exciting (and busy) year.

Work

Prior to FIRE’ing the first time I was a corporate career drone. That was not my dream. I also found a cold turkey no job retirement along with a move to The Med too much to devour all together. Today, 3 years in to FIRE my work situation is I have a job that is 100% work from home, is 4 days per week, carries no stress and while definitely not being my purpose does allow me to interact positively with some really clever interesting people. It’s working really well for now.

Into 2022 I expect I’ll be looking to reduce those number of days further but I can see this being an interesting conversation because I don’t think it’s what my company has in mind. They’re trying to push me into a ‘career’ with them. So much so that they’ve spent real money on me to help me figure out what I want to do. Been there, done that, got the t-shirt – no thanks!

Relationships

In recent years a number of reasonably prominent FIRE bloggers have found themselves divorced. They were very ‘professional’ in sharing what had happened without airing the dirty laundry. I’m however starting to understand how FIRE can potentially allow it happen.

When Mrs RIT and I met we both had our corporate careers spending long hours in the office and not as many hours together. There was stress and basic survival stuff in play. After all this was pre-FIRE. We also had lots in common given our stage of life including we were both limited in the true pursuit of our dreams.

Mrs RIT FIRE’d long before I did and she jumped in with both feet but where I sank she swam along like a graceful swan. She has pursued her passion with unrelenting energy and is loving life but this means she as a person has changed a little with it. How could she not.

This year particularly as I’ve found a work life balance that is really working for me I’ve also been able to invest significant time in me and who I am. Just like Mrs RIT as I embraced that I also change a little as well.

The end result is that we are now both different people to who we were and it 100% is putting a little strain on the relationship. Fortunately, we’re both very aware of it and working through the challenges it creates but I now understand how FIRE could potentially cause relationships to end.

Finances

Where I used to obsess about finances these days it’s all a bit meh. But given the history of this blog maybe a few titbits.

In 2021 we’ll spend about 1.9% of my wealth. Once our home is built that spending will reduce significantly as we won’t be paying rent and our electricity bill will fall significantly.

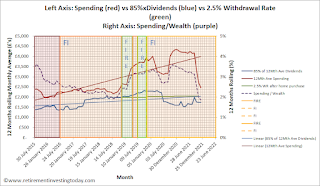

I’ve also changed my approach to withdrawal. My criteria at FIRE was to spend the lesser of:

- up to 2.5% of initial FIRE wealth (plus investment expenses of around 0.2%) uprated for inflation annually.

- up to 85% of my annual dividends.

On the 2.5% Safe Withdrawal Rate (SWR) front we’ll be well under but at this point it really doesn’t matter as my work more than covers the spending including the purchase of very nice new bicycles.

On the 85% of dividends front I’ve abandoned the target. This is not because of the poor dividends of late but is just a function of the investing landscape here in Australia. In Australia the equivalent of a private pension is called Superannuation (Super) and there seem to be 3 main ways to go about it – Retail Super Funds, Industry Super Funds and Self Managed Superannuation Funds (SMSFs). Retail Super Funds seem to me to be high fee and run for the benefit of the business owners. SMSFs are something you build yourself with an accountant – it’s your fund – but with that comes significant fees as there are reporting requirements. I’ve gone with an Industry Super Fund for now.

Positively, I also get a completely new and different set of personal pension allowances with Superannuation. There is no interaction between my UK SIPPs and my Australian Superannuation from an allowances perspective. So while if history repeats I expect to be “just” under the UK Pension Lifetime Allowance with my UK SIPP by 55 my Australian Super will not be considered and instead is subject to its own limits and rules. It’s accessible at 60 and is tax advantageous so it’s game on with $120,000 already squirrelled away.

Over the years as I approach age 55 and if Mr Market behaves I then plan to move large chunks (Australian capital gains tax is very relevant here with my ISA investments cost base being the day I became an Australia resident) of my ISA (it’s not tax advantaged under the Australian tax system) into my Superannuation and there will also be some tricks to play when I take my 25% tax free lump sum at age 55 (given current rules which of course might change) as part of it will be taxed here in Australia should we still be here at that point.

The Industry Superannuation fund I’ve chosen allows me to index track with low fees. The negative is that the funds within the Superannuation wrapper are effectively accumulation funds and not income funds meaning I don’t see dividends. Given I expect this to end up a significant portion of my wealth as the years progress the 85% of dividends target just becomes a nonsense so is dropped.

In graphical terms my FIRE journey so far looks something like this (Note: the 2.5% SWR already nets off the expected housing spend backdated to my original FIRE date so I can measure myself against it once we move into our new home but until then it appears as though we’re overspending):

Click to enlarge, RIT Spending vs 85% of Dividends vs 2.5% Withdrawal Rate vs Spending/Wealth

Conclusion

3 years into FIRE (under my definitions I actually believe I’m only FI at this point so please no internet retirement police) and after a bit of a rough start I think I’m finally starting to get the hang of this FIRE lark. I’m now really into my stride with a lot of change done and to go but at the same time life is good. No, let me correct that. Life is very very good!

I’m still convinced FIRE was the right thing to pursue for me.

Really interesting post, thank you for sharing. I think many folks take a rather too simplistic view of FI-RE and in reality many will be on a journey like yourself (if not literally across the globe!) but in adjusting, changing, modifying things as you go along rather than right 2.5/3/4% SWR forever and sail off in to the sunset...

ReplyDeleteGreat to see you back for your annual blog post RIT!

ReplyDeleteYour position is enviable and sort of inspires me - except your explicit omission of mentioning kids makes me think that you don't have any and that makes things a bit simpler.

Glad to hear that you can happily WFH 4 days a week and keep your mind sharp.

I have that (sort of - maybe more stress ) and it's ideal.

I'm still impressed with your figures but you are experiencing a bit of lifestyle creep.

Good luck for 2022!

Always fantastic to see an update, RIT.

ReplyDeleteI reached my FI number around the same time as you - and am similarly working 4 days a week from home (although spent a good chunk of the last year or so working 3 days a week). I suspect I will have retired fully within a few years. I keep meaning to do so, but interesting and relatively stress-free work projects keep turning up.

It would be good to hear more about your house building project once completed!

Is this your picture? I imagined you looking different.

ReplyDeleteI've been looking forward to this post! Thought-provoking update RIT and all the better because you don't shy away from the downsides.

ReplyDeleteI could debate vaccine ethics with you all day :-)

It seems to me that it's an epidemiological offshoot of the trolley problem. The hospital trolley problem!

Theoretically we can construct scenarios where we'd probably agree it's OK to lie or even kill e.g. to stop Hitler. Or to stop the detonation of a dirty bomb by a terrorist.

Similarly, there must be a moral threshold where the stress upon society of vaccine hesitancy and denial justifies a mandate.

Morality in the real world is much messier of course. But we trade off individual liberties for the common good all the time.

I think society should think long and hard about the consequences, but it seems justifiable to me to bring greater social pressure to bear on individuals who insist on putting fellow citizens at risk without due cause.

N.B. I don't know enough about the Australian or Austrian situations to have an opinion on those measures.

I just want to put the case for not judging these situations in absolute terms i.e. always right, or always wrong.

OK, I wrote more about that than I intended! Feel free to delete because I don't want to hijack the thread.

Back on topic, the part of the post I most enjoyed was this:

"Life is very very good!"

Great to hear RIT. +1 for more updates!

"it seems justifiable to me to bring greater social pressure to bear on individuals who insist on putting fellow citizens at risk without due cause. "

DeleteGood grief! You need to look at the UK's Vaccine Surveillance report 31st March. It's incredible that some people still think not being jabbed puts others at risk. The stats show that per 100k triple jabbed have 400% the infections rates of people not jabbed. Also look at the hospitalisation and death rates. In fact that was the last report where they provide a breakdown by jab status because the figures have become increasingly embarrassing for the jab mandate pushers. Please wake up and smell the coffee, instead deriding sensible people for making a logical decision.

Good to get another update from you RIT. Some interesting observations.

ReplyDeleteBuilding my own house is something I’ve sent longer studying than FIRE. I’m sure you are doing plenty of research, but I’d recommend including Patterns of Home: The Ten Essentials of Enduring Design among your resources as a jumping of point for designs and features that have a high ROI.

All the best

OIMO

Hi RIT

ReplyDeleteFor some reason, my comment didn't save so I'll post again.

Great to see you posting and update and to read that you and your family are ok down under and that life is good for you.

You never came across as the type to do the full 'no working when FIRE'd' - not with the effort and energy you put into your career, it would have been difficult to replace that, unless it was a full blown full time hobby of some sort. Good to hear that you are enjoying working a 4-day week.

All the best for 2022.

Great post and like all readers I'm pleased you are settling into life in Aus.

ReplyDeleteLike the update, glad settling in Oz and great honesty about situation. Skeptical about 'RE of fire anyway, as Most fire bloggers seem to be accumulating or swop salaried work for blogging and side gigs so not really retired.

ReplyDeleteI did a year out and can say got bored of it by the end and hobbies not fill all your time, just end up getting lazy.

From my experience back to the office can help marital relationship as Not easy spending 24-7 together, and of course income comes in handy, esp with prices going up and ukraine stock market correction. Take care

Keen for an update on the latest position as of December. My year has been a disaster and I feel there is more to come.

ReplyDeleteThe latest ofdollarsanddata post featuring how Saving Hard matters more than Investing Wisely brought me here. This is where I initially heard the phrase and it hit home for me.

ReplyDeleteI expected to see higher Saving Hard values in your older post (http://www.retirementinvestingtoday.com/2014/11/its-all-about-living-well-below-your.html) but still... the point stands.

Hope all is well with you RIT!

http://www.retirementinvestingtoday.com/2021/12/transitioning-musings-on-2021.html

ReplyDeleteHa ha - how is the transitioning going ?

The term has taken on a different meaning now.

Your silence is deafening. Don't you owe it to your " disciples " to let them know how wrong and misguided all your attempts at FIRE have proved to be ? Now is your chance to tell us the truth- and help some of those other FIRE enthusiasts what has become of your dream , where you went wrong , what you are now doing about it and announce a dose of realism.

Go on- I dare you.

Silence will be an admission of your failure.

Hey RIT no update for 2022 yet?? I always enjoy your yearly summary posts

ReplyDelete