I don’t think it’s too controversial to suggest, that at its simplest, a modern portfolio will contain bonds (whether government and/or corporate, domestic and/or international, index linked and/or otherwise) and equities (whether domestic, international developed and/or emerging). I make this statement as bonds and equities are two asset classes that historically have exhibited different properties that when combined can work together to give some interesting characteristics. Tim Hale describes the differences well – “Equities have an economic rationale for and history of delivering mid-digit real returns (after inflation) and are considered the engines of portfolio returns, but with considerable and sometimes extremes swings in returns... High quality domestic bonds on the other hand, tend to have far smoother return patterns at a cost of lower returns, which come in the low single digits, after inflation.”

describes the differences well – “Equities have an economic rationale for and history of delivering mid-digit real returns (after inflation) and are considered the engines of portfolio returns, but with considerable and sometimes extremes swings in returns... High quality domestic bonds on the other hand, tend to have far smoother return patterns at a cost of lower returns, which come in the low single digits, after inflation.”

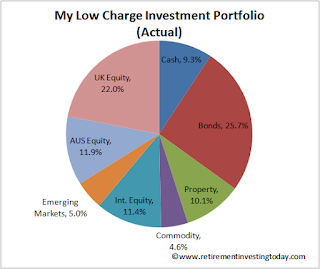

I probably make it more complicated than it needs to be but at its heart my portfolio is not much more than a 32% bonds/68% equities portfolio which at its conclusion will likely settle at a 40% bonds/60% equities portfolio. In comparison I’ve recently starting noticing more and more personal finance bloggers who are holding far lower or even no bond allocations in their portfolios. This has had me thinking:

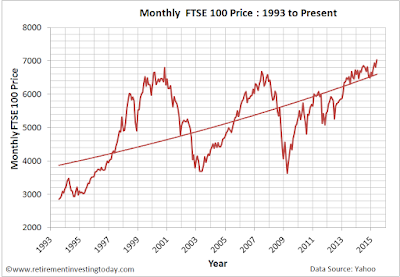

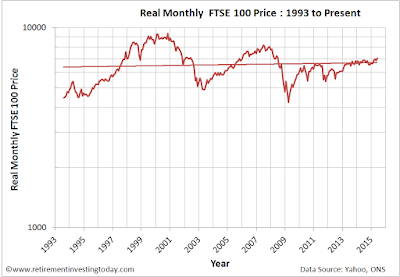

To make sure it’s not number 1 let’s spend some time going back to fundamentals to understand if bonds combined with equities are still doing their thing. I’ve been able to source 10 full calendar years (not quite for the bonds as I’ve only been able to go back to 29 March 2004 but close enough) of total return bond and equity performance covering the years 2004 to 2014. The bonds are the Markit iBoxx GBP Liquid Corporates Large Cap Index and the equities are the FTSE 100. Armed with this information I can calculate the annual return possible for everything from 100% bonds, through various mixed bond/equity allocations to 100% equities for each year. I can then calculate the volatility (I’ve used standard deviation to represent volatility) for each allocation for the 10year period. The 100% Bonds portfolio has volatility of 7.2%, the 40% Bonds/60% Equities has 10.7% while the 100% Equities has 14.8%. This is all shown in my first table below.

I probably make it more complicated than it needs to be but at its heart my portfolio is not much more than a 32% bonds/68% equities portfolio which at its conclusion will likely settle at a 40% bonds/60% equities portfolio. In comparison I’ve recently starting noticing more and more personal finance bloggers who are holding far lower or even no bond allocations in their portfolios. This has had me thinking:

- has the significance of bonds in a portfolio disappeared;

- is it correlated to us now having been in a bull market since 2009;

- is it because my high savings rate encourages and allows me to live the Warren Buffet quote “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1” where others might be chasing higher yields; or

- is it just simply that I’m now nearing the end of my rapid wealth generating journey and others are a little earlier on in theirs.

To make sure it’s not number 1 let’s spend some time going back to fundamentals to understand if bonds combined with equities are still doing their thing. I’ve been able to source 10 full calendar years (not quite for the bonds as I’ve only been able to go back to 29 March 2004 but close enough) of total return bond and equity performance covering the years 2004 to 2014. The bonds are the Markit iBoxx GBP Liquid Corporates Large Cap Index and the equities are the FTSE 100. Armed with this information I can calculate the annual return possible for everything from 100% bonds, through various mixed bond/equity allocations to 100% equities for each year. I can then calculate the volatility (I’ve used standard deviation to represent volatility) for each allocation for the 10year period. The 100% Bonds portfolio has volatility of 7.2%, the 40% Bonds/60% Equities has 10.7% while the 100% Equities has 14.8%. This is all shown in my first table below.

Click to enlarge, Portfolio Annual Return if Bonds/Equities Allocation Rebalanced at Start of each Year