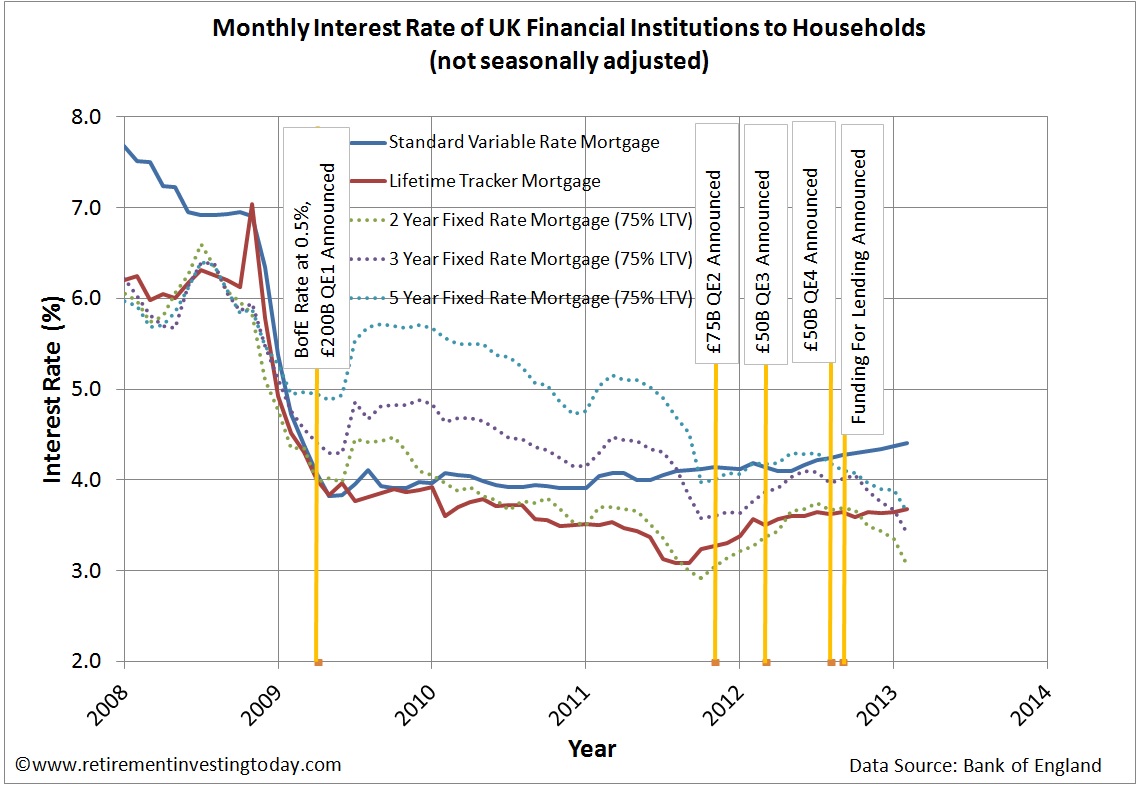

Let’s firstly look at the raw data. The Bank of England publishes a number of datasets on this topic and I have picked 5 which cover the more common mortgage types available today. They are the sterling monthly mortgage interest rate of UK monetary financial institutions (excluding Central Bank) covering:

- Standard Variable Rate (SVR) mortgages. These continue to rise. Today they sit at 4.4%, up 0.03% month on month and 0.22% year on year.

- Lifetime Tracker mortgages. These also continue to rise. Currently they are 3.68% which is a monthly increase of 0.04% and a yearly increase of 0.11%.

- 2, 3 and 5 Year Fixed Rate Mortgages with a 75% loan to value ratio (LTV) on the other hand are falling significantly. These are the mortgages you would expect to be affected by the Funding for Lending Scheme. This is because the Scheme is “theoretically” only available for a limited period. (As a reminder the scheme started on the 01 August. From this date Banks and Building Societies have access to the scheme for 18 months with the scheme allowing borrowing for a period of up to 4 years.) Today we see these mortgages at 3.06% (down 0.29% on the month, 0.21% on the year), 3.41% (down 0.26% on the month, 0.36% on the year) and 3.65% (down 0.24% on the month, 0.53% on the year) respectively. Since the scheme started the falls are 0.63%, 0.60% and 0.46% respectively.

Click to enlarge

What this all means is that today an average 2 year fixed mortgage can be had for a real (inflation adjusted) rate of -0.22%. Yes you read that right. Mortgage rates in real terms are negative. 3 and 5 year real rates are also negligible at 0.13% and 0.37% respectively. The question is how much lower can they drive rates in nominal terms? I can’t see it being much further given that the Bank of England want and will do everything they can to engineer inflation. Tracking these rates for the next few months will give us a good steer.