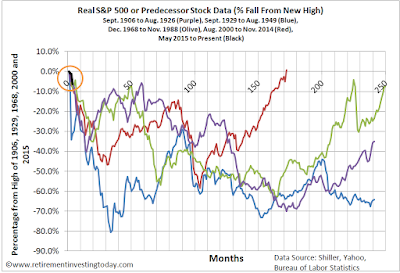

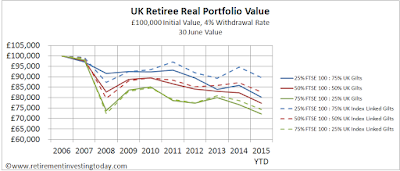

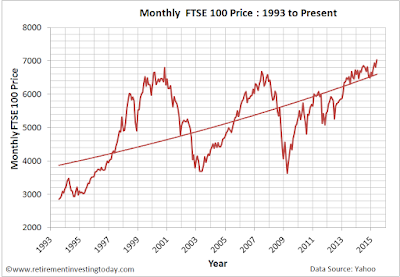

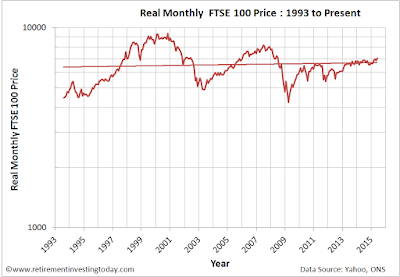

Stock market prices go up and down continuously. Stock market prices also trend up and down over longer periods of time. In recent weeks we've been seeing prices go down at a faster rate than up resulting in a trend downwards. This has resulted in plenty of press/blog inches from experts trying to explain what’s going on.

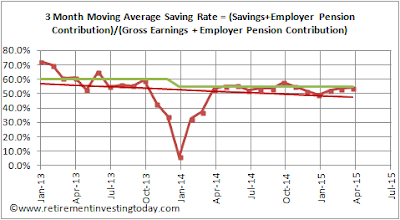

In response to this my investing strategy is unchanged despite having lost, on paper at least, over £53,000 from my peak 2015 wealth valuation even after new contributions. That is multiple years of post FIRE spending and so not an insignificant amount of money. I continue to passively rebalance but importantly everything is done in slow motion and contains no ‘backing the truck up’ or ‘going all in’. I think of it as investing at the pace of a sloth.

I do this because even though there is lots of investing noise around I am very conscious that price down trends can occur for long periods of time. Let me demonstrate with a chart looking at US stock market price downtrends.

In response to this my investing strategy is unchanged despite having lost, on paper at least, over £53,000 from my peak 2015 wealth valuation even after new contributions. That is multiple years of post FIRE spending and so not an insignificant amount of money. I continue to passively rebalance but importantly everything is done in slow motion and contains no ‘backing the truck up’ or ‘going all in’. I think of it as investing at the pace of a sloth.

I do this because even though there is lots of investing noise around I am very conscious that price down trends can occur for long periods of time. Let me demonstrate with a chart looking at US stock market price downtrends.

Click to enlarge, US Market Percentage Falls from Real New Highs