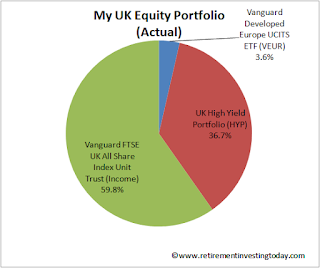

The vast majority of my investment portfolio is made up of passive index tracking funds. Why? Well as a person who’s now been investing heavily for a bit over 7.5 years I personally believe this is the best way for me to achieve my wealth ambitions. One exception to this is my High Yield Portfolio (HYP) which is held within the Equities portion of my portfolio and can only be described as active investing. So if I'm a tracker believer what am I doing actively investing I hear you ask.

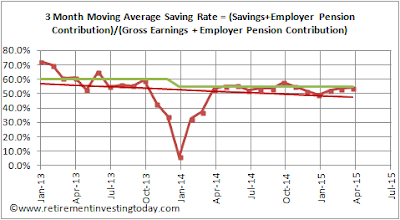

Simply, while 99% of my investing is all about non-emotional investing my HYP is an outlier as it’s there for psychological reasons. I’m now fast approaching optional very early retirement and when in that retirement I’m going to be likely 100% living off my wealth. I’m going to do this by drawing down from my wealth at the rate of 2.5%. I have two ways to do this – spend dividends/interest and/or sell down capital. For me, particularly in a severe bear market, I think that spending dividends/interest will psychologically be far easier and less disruptive to life than being forced to sell down capital. With that in mind before retirement I’m trying to ensure that the dividends/interest I receive annually is as close to 3% of wealth as possible. If I can achieve 3% in the good times I can draw down 2.5% and reinvest 0.5% and in the bad times I have some buffer to allow for dividend attrition.

This psychological advantage is however a fool’s errand if it causes my total portfolio to underperform the market. Unemotionally what matters is Total Return which is Capital Appreciation plus Dividends. So with this in mind I watch my HYP performance, particularly capital gains, like a hawk. So as we pass the mid-year point of 2015 let’s take a look at my HYP's performance to date.

Firstly to what the HYP is all about – Dividends. Performance here is still very good with the portfolio currently sitting on a trailing yield of 5.2% which is 1.4 times the FTSE100’s 3.6%. So far so good.

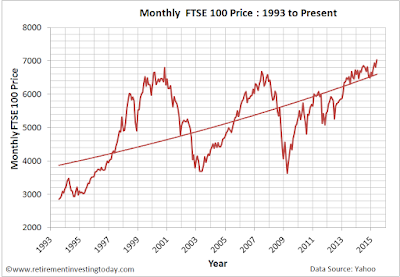

Now let’s look at the risk associated with buying big, boring, non-cyclical industries – Capital Gains. Since inception in November 2011 this is also ok. The HYP has returned a gain of 31.0% vs the FTSE100’s 25.6%. Where it gets interesting though is year to date gains to today. Here the HYP has fallen by 1.7% vs the FTSE100’s gain of 1.6%.

Click to enlarge, RIT UK Equities Portion of Total Portfolio

Simply, while 99% of my investing is all about non-emotional investing my HYP is an outlier as it’s there for psychological reasons. I’m now fast approaching optional very early retirement and when in that retirement I’m going to be likely 100% living off my wealth. I’m going to do this by drawing down from my wealth at the rate of 2.5%. I have two ways to do this – spend dividends/interest and/or sell down capital. For me, particularly in a severe bear market, I think that spending dividends/interest will psychologically be far easier and less disruptive to life than being forced to sell down capital. With that in mind before retirement I’m trying to ensure that the dividends/interest I receive annually is as close to 3% of wealth as possible. If I can achieve 3% in the good times I can draw down 2.5% and reinvest 0.5% and in the bad times I have some buffer to allow for dividend attrition.

This psychological advantage is however a fool’s errand if it causes my total portfolio to underperform the market. Unemotionally what matters is Total Return which is Capital Appreciation plus Dividends. So with this in mind I watch my HYP performance, particularly capital gains, like a hawk. So as we pass the mid-year point of 2015 let’s take a look at my HYP's performance to date.

Firstly to what the HYP is all about – Dividends. Performance here is still very good with the portfolio currently sitting on a trailing yield of 5.2% which is 1.4 times the FTSE100’s 3.6%. So far so good.

Now let’s look at the risk associated with buying big, boring, non-cyclical industries – Capital Gains. Since inception in November 2011 this is also ok. The HYP has returned a gain of 31.0% vs the FTSE100’s 25.6%. Where it gets interesting though is year to date gains to today. Here the HYP has fallen by 1.7% vs the FTSE100’s gain of 1.6%.