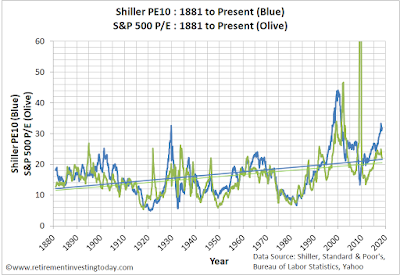

I was recently reading a FIRE blog post, from a couple who are still very much deep in the swim phase of the FIRE triathlon, where the post was exploring who in society has the opportunity to FIRE if they so choose. Of course as many of us FIRE bloggers love a good spreadsheet, the weapon of choice for exploring this was an Excel model and a whole pile of assumptions. Two of these assumptions were that we were living in a hypothetical world where there is no inflation and where the expected annualised investment portfolio return was 7%. So to my reading a critical assumption in their Excel model was a real (ie after inflation) portfolio return of 7%!

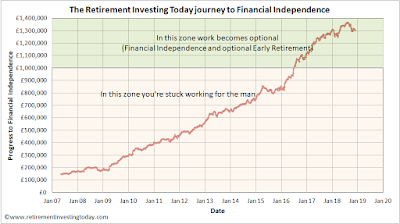

I’m much further on the FIRE journey than these good folks being in the triathlon bike phase having now been FIRE’d for a little over a year and having been on my FIRE journey for around twelve years. At one end this means I have more experience and data than these folks but it also means I’m more grey, grizzled and cynical. With that warning out of the way to me that real 7% return assumption just seems way to bullish! So I then asked myself why are they using such high returns in their model as not for a second do I think they are trying to deceive? The simple answer I came up with is that the vast majority of FIRE blogs are from people who are pre-FIRE with many never having witnessed a bear market so they have no real life data, only published financial data. Then from those that are FIRE’d I am yet to see transparent long term portfolio returns shared. So today’s post aims to do just that. Put a stake into the ground where hopefully your comments and other bloggers posts will tear my investing performance apart showing me to be either a poor, average or good investor. With time that might help us all fine tune the expected returns we can all plug into our much loved spreadsheets.

I’m much further on the FIRE journey than these good folks being in the triathlon bike phase having now been FIRE’d for a little over a year and having been on my FIRE journey for around twelve years. At one end this means I have more experience and data than these folks but it also means I’m more grey, grizzled and cynical. With that warning out of the way to me that real 7% return assumption just seems way to bullish! So I then asked myself why are they using such high returns in their model as not for a second do I think they are trying to deceive? The simple answer I came up with is that the vast majority of FIRE blogs are from people who are pre-FIRE with many never having witnessed a bear market so they have no real life data, only published financial data. Then from those that are FIRE’d I am yet to see transparent long term portfolio returns shared. So today’s post aims to do just that. Put a stake into the ground where hopefully your comments and other bloggers posts will tear my investing performance apart showing me to be either a poor, average or good investor. With time that might help us all fine tune the expected returns we can all plug into our much loved spreadsheets.