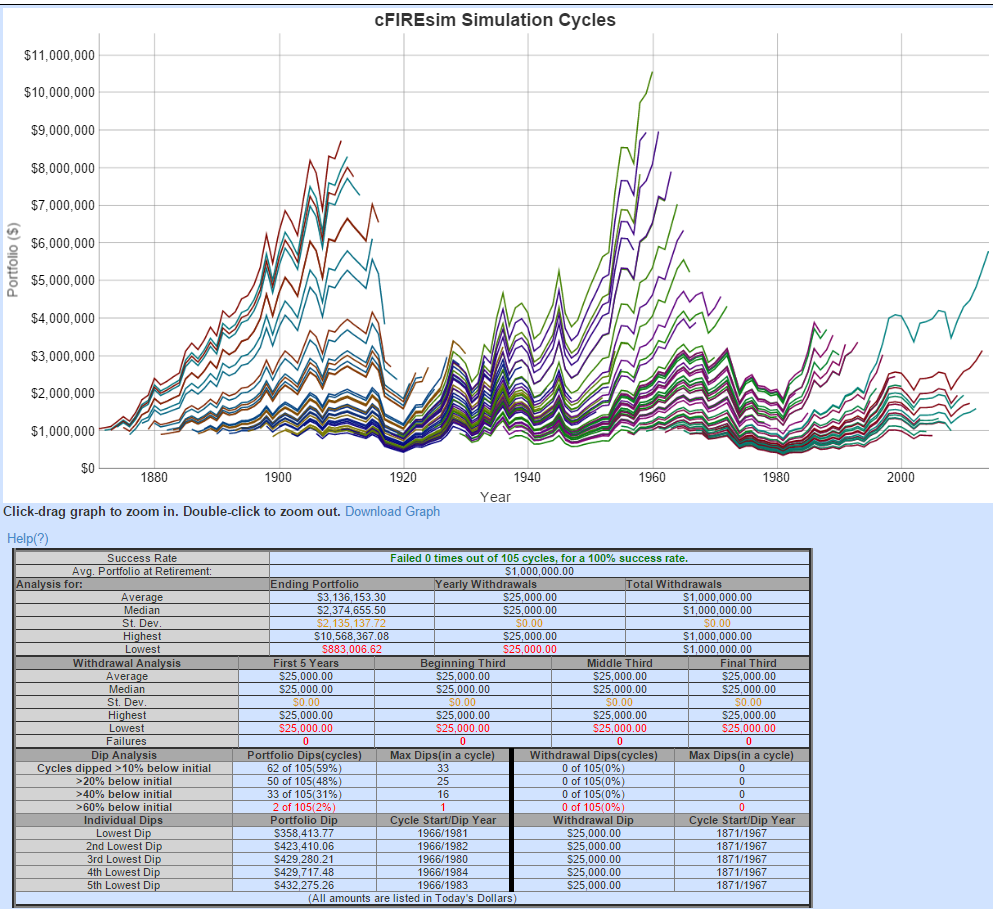

Anybody who is intending to retire (particularly those taking early retirement) without a healthy Defined Benefit Pension or without knowledge of a guaranteed healthy inheritance should be wary of and maybe even have a healthy fear of sequence of returns risk. It is the risk of receiving a series of investment returns that are negative (or lower) during a period when you are in portfolio/wealth drawdown which then never allows your wealth to recover even when investment returns normalise.

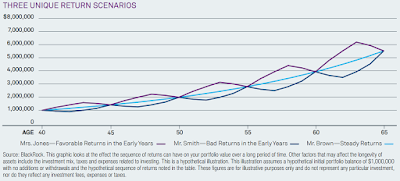

Blackrock have a couple of charts which demonstrate the phenomena nicely. Firstly, let’s look at Sequence of Returns during the Wealth Accrual Phase (ie before Retirement). The chart below shows 3 investors who each make an initial investment of $1,000,000 at age 40 and then never invest again. Each has an average annual return of 7% but each experiences a different sequence of returns. 25 years later each has the same portfolio value even though valuations varied along the way.

Now let’s look at Sequence of Returns during the Wealth Drawdown phase. Again we have our 3 investors making the same initial $1,000,000 investment, the same average annual return of 7% with annual returns following the same sequences as during the Wealth Accrual Phase. 25 years later each have very different portfolio values with Mr White now forced to beg for food under a bridge.

Blackrock have a couple of charts which demonstrate the phenomena nicely. Firstly, let’s look at Sequence of Returns during the Wealth Accrual Phase (ie before Retirement). The chart below shows 3 investors who each make an initial investment of $1,000,000 at age 40 and then never invest again. Each has an average annual return of 7% but each experiences a different sequence of returns. 25 years later each has the same portfolio value even though valuations varied along the way.

Click to enlarge, Sequence of Returns during Wealth Accrual Phase

Now let’s look at Sequence of Returns during the Wealth Drawdown phase. Again we have our 3 investors making the same initial $1,000,000 investment, the same average annual return of 7% with annual returns following the same sequences as during the Wealth Accrual Phase. 25 years later each have very different portfolio values with Mr White now forced to beg for food under a bridge.