Security of employment is not what it was once. Changes including globalisation, technology, automation and lean (lean is basically doing more with less through the elimination of waste), amongst others, have sent it well on its way. We see lack of security of employment manifest itself in many ways with one of the more recent ones making headlines in the mainstream media being zero hours contracts.

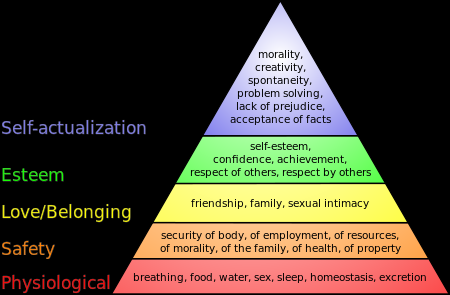

The problem with this change is that without security of employment there is always the risk of starving to death (maybe an extreme example given the UK’s welfare state status, but certainly not in some countries and hopefully you get my drift). According to Maslow’s Hierarchy of Needs inability to correct for this deficiency need (or d-need) then prevents one from ever reaching Self-Actualisation which is essentially the realisation of your full potential.

Personally, in my current career I’m also under no illusion of having any sort of security of employment. I know that my current security is linked to nothing more than my last performance review or (not and) nobody anywhere else in the world being able to offer the equivalent service for a lower cost. Part of this is within my control, but mistakes do happen, and part of this is outside my control.

With time I’ve come to realise that my solution to this problem in the short term has been to keep my skills current (the 1% inspiration) and then work hard (the 99% inspiration). So far this is working with a recent notification that I’ll be receiving a salary increase of 4% and a bonus that exceeds my notional amount in recognition of my performance last year. I never thought too much of this work hard approach, including was it too extreme, but when readers last week made comments like;

and;

it really did make me take a step back and think.

The problem with this change is that without security of employment there is always the risk of starving to death (maybe an extreme example given the UK’s welfare state status, but certainly not in some countries and hopefully you get my drift). According to Maslow’s Hierarchy of Needs inability to correct for this deficiency need (or d-need) then prevents one from ever reaching Self-Actualisation which is essentially the realisation of your full potential.

Click to enlarge, Source: www.convene.com

Personally, in my current career I’m also under no illusion of having any sort of security of employment. I know that my current security is linked to nothing more than my last performance review or (not and) nobody anywhere else in the world being able to offer the equivalent service for a lower cost. Part of this is within my control, but mistakes do happen, and part of this is outside my control.

With time I’ve come to realise that my solution to this problem in the short term has been to keep my skills current (the 1% inspiration) and then work hard (the 99% inspiration). So far this is working with a recent notification that I’ll be receiving a salary increase of 4% and a bonus that exceeds my notional amount in recognition of my performance last year. I never thought too much of this work hard approach, including was it too extreme, but when readers last week made comments like;

“I appreciate this is the path you've chosen, and for well thought out reasons, but your hours of work sound awful“;

and;

“Holy s**t - good job you have an escape plan as that is a brutal life you currently have carved out for yourself - 16 hour days! You must be tough as nails!”;

it really did make me take a step back and think.