You don’t have to travel far into most personal finance sites before you find the obligatory compound interest post. Even I did one back in 2012 where I was so bold as to call it The Miracle of Compound Interest.

In brief Compound Interest, sometimes also called the snowball effect, is at its most basic just interest on interest. A trivial example. Let’s say you have £1 and can get an investment return of 10% per annum (those were the days). Choose that option and after a year you’d have £1.10 which is your £1 plus ‘interest’ of £0.10. If you reinvest that for another year you’d have £1.21 which is your £1, last years interest of £0.10, this years interest of £0.10 on your £1 but also £0.01 which is interest on your £0.10 interest from last year. Interest on interest...

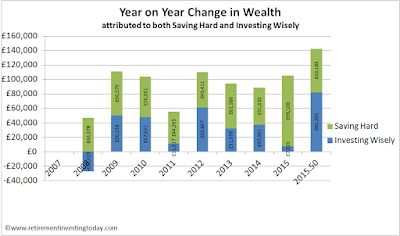

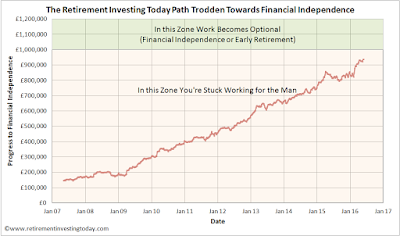

So that’s the lovely theory but as someone who is now Financially Independent and so has been there, done that, got the t-shirt, what’s my view on it. I’d now say care is needed. Let me demonstrate with three simple examples. Let’s go back in time to the end of 2007 where I’m going to give each of our punters seed capital of £50,000, I’m going to assume a real (after inflation) return of 4.1% (what I’ve achieved on my portfolio of trackers after expenses) and I’m going to assume their each looking for wealth of £800,000 (which is not far off what I thought I needed back then although inflation since has ensured I now need 2 commas) before packing in the day job. From here their journeys will vary:

In brief Compound Interest, sometimes also called the snowball effect, is at its most basic just interest on interest. A trivial example. Let’s say you have £1 and can get an investment return of 10% per annum (those were the days). Choose that option and after a year you’d have £1.10 which is your £1 plus ‘interest’ of £0.10. If you reinvest that for another year you’d have £1.21 which is your £1, last years interest of £0.10, this years interest of £0.10 on your £1 but also £0.01 which is interest on your £0.10 interest from last year. Interest on interest...

So that’s the lovely theory but as someone who is now Financially Independent and so has been there, done that, got the t-shirt, what’s my view on it. I’d now say care is needed. Let me demonstrate with three simple examples. Let’s go back in time to the end of 2007 where I’m going to give each of our punters seed capital of £50,000, I’m going to assume a real (after inflation) return of 4.1% (what I’ve achieved on my portfolio of trackers after expenses) and I’m going to assume their each looking for wealth of £800,000 (which is not far off what I thought I needed back then although inflation since has ensured I now need 2 commas) before packing in the day job. From here their journeys will vary:

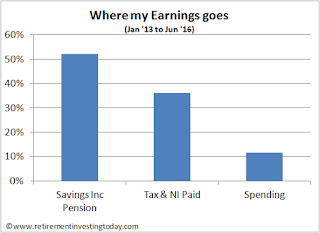

- TheRIT will crack on with working hard, focus on quality of life and so annually squirrel away £58,728 per annum (which is the average annual savings I’ve achieved since I’ve been on my FIRE journey, equating to a post tax Savings Rate of 82.4%) earning a real return of 4.1% per annum (my actual real annualised return thus far). I know that will include inflation adjusted savings but please give me a little slack here as it’s not important to the point I’m trying to make today so won’t bother with inflation adjusting.

- MrAverage will also crack on with working hard but instead focuses on standard of living. This means he can only save 5.1% of post tax earnings which has been deliberately chosen as it’s the current UK household saving ratio according to the ONS. Like TheRIT, MrAverage achieves a real return of 4.1%.

- MissInvestingSuperstar follows in the footsteps of MrAverage but boy does she know her stuff when it comes to picking winners. So much so that every year that she invests she manages double the return of the others and so achieves a real 8.2% per annum. Ask yourself how many people actually achieve that and would you be prepared to back yourself to achieve that with severe disappointment many years hence if you don’t?

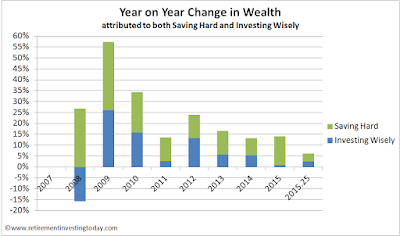

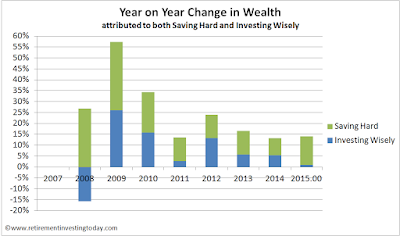

Click to enlarge, My after tax Savings Rate over the long term has been 82.4%