Buying (New money): Since my last post I have saved 83% of my net earnings. In addition some more good news was that significant earnings that I had been waiting on for the past year were paid to me this month meaning my total savings amount was also very large at 6.1% of my Low Charge Portfolio assets. These were allocated as follows: 84.7% to cash, 2.3% to UK equities, 3.2% to international equities, 0.6% to index linked gilts and 9.2% to UK commercial property. This money was invested both outside of any tax wrappers and also within a pension. Unfortunately no investment was made into my stocks and shares ISA as I have already made my £7,200 worth of contributions. I am eagerly waiting for the new ISA year starting on the 06 April 2010.

Thursday 11 March 2010

Wednesday 10 March 2010

Australian Property Market (Alternate Data) – February 2010 Update

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.

Tuesday 9 March 2010

Frugal living – pay yourself first and the lowest price grocery bill

I am trying to achieve retirement within 7 years. I’m defining retirement as work becoming optional. To do this I am generally saving 60% of my gross earnings every month. How have I managed to get to this high level? Well I think it’s a high level, if you’re doing better or similar I’d love to hear your methods. In fact I’d like to hear anyone’s suggestions for methods to save money. Please feel free to comment.

Monday 8 March 2010

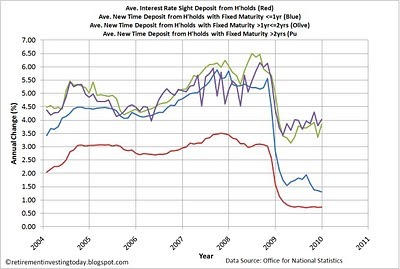

Average UK interest rates for savers

Previously I described how I was struggling to find a home for cash that could generate a real return after inflation and tax. The best rate I could find for a basic no frills easy access account was 2.5% but my chart today shows how bad it really is out there.

Sunday 7 March 2010

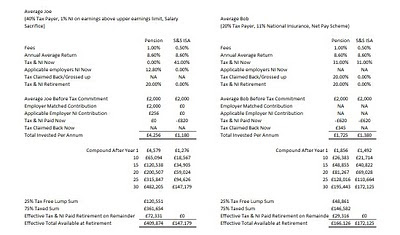

Are pensions a good retirement planning tool? (Full text)

Where is the best place to put your money for retirement? Ask a lot of people and the automatic response is that you should put your money in a pension to get a bigger retirement pot which comes from the tax advantages given by HMRC. I however am not convinced and in fact believe the government and the pensions industry is actually close to misleading the public as to the advantages of pensions.

Subscribe to:

Posts (Atom)