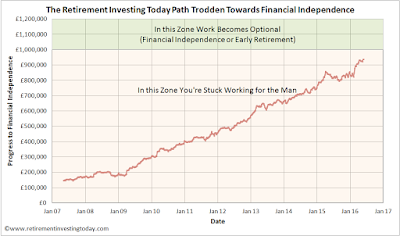

Click to enlarge, My path trodden towards financial independence

Today, I have wealth of £938,000. This is also my net worth as I have £0 in debt. With a FIRE (financially independent and retired early) target of £1,000,000 and provided Mr/Mrs Market behaves him/herself I should be able to close that gap in 6 months according to my Excel spreadsheet. That is not far away and now requires me to do some things over the coming months.

1. Pick an early retirement date

Into the melting pot for this decision goes:

- the weather. Not much point moving in the middle of winter.

- tax efficiency. As I’ll have the opportunity to work for only part of the year it seems to make sense to earn enough in a tax year to take me up to the start of the 40% higher rate income tax rate to maximise my FIRE wealth for a given work effort.

- work projects. I do have some longer term projects at work that I would like to finish. I know I don’t have to but for me at least I feel it is the right thing to do both for myself and those who work around me.

- assured shorthold tenancy (AST). As a renter I have a tenancy period that I need to comply with. There is no point paying rent on a flat that is empty.

Working through each of these in turn and it looks like I’ll actually resign in late winter/early spring 2017 with a plan to be in The Med in late spring/early summer 2017. So at this stage it looks like I will be overshooting what is physically possible financially and I’m ok with that. I’ll only be 44 years of age after all. It’s not like I’m planning to do One More Year (OMY) or anything like that...

2. Ensure my portfolio is right for distribution and not accumulation

When I built my investment strategy it was all about the accumulation of wealth. That book is now fast coming to a close and I’m about to start a new book called Starting out in the Retirement Distribution phase. My investment portfolio today looks like this: