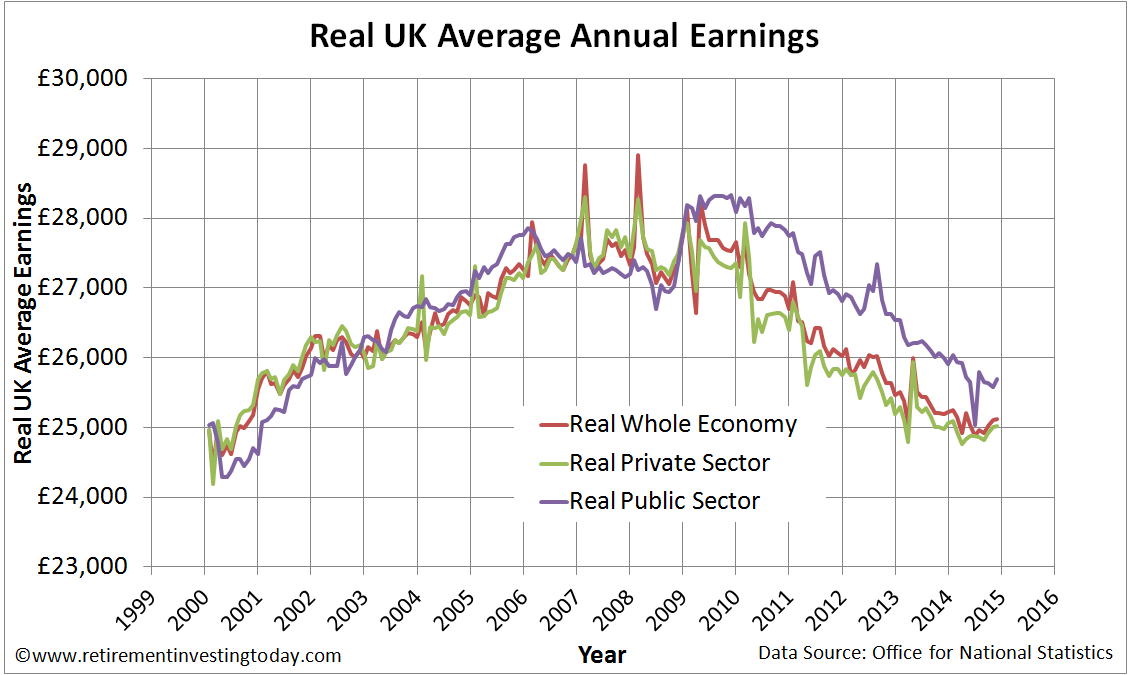

UK pay or earnings seems to have reached the main stream media again. By my calculations Average Whole Economy Annual Earnings are increasing at a rate of 1.7% with inflation over the same period at 2.0%. So on the whole the average punter’s purchasing power continues to be eroded. To be honest I can’t say I'm surprised and think this is going to continue for a long time yet. As the world continues to globalise then the difference between poorer salaried and richer salaried countries must close.

The Private Sector is fairing a little better than average and has kept pace with inflation having risen by 2.1%. Austerity does look to be biting the public sector though with increases of 0.8% which is well below inflation.

The chart below shows the wider real adjusted for inflation UK earnings story. The summary is pretty simple – real UK earnings for both the public and private sectors are still well below those of 2007 to 2009. Though is that a sustainable uptick I can start to see beginning to occur before me? Given what I’ve said above I’m not convinced.

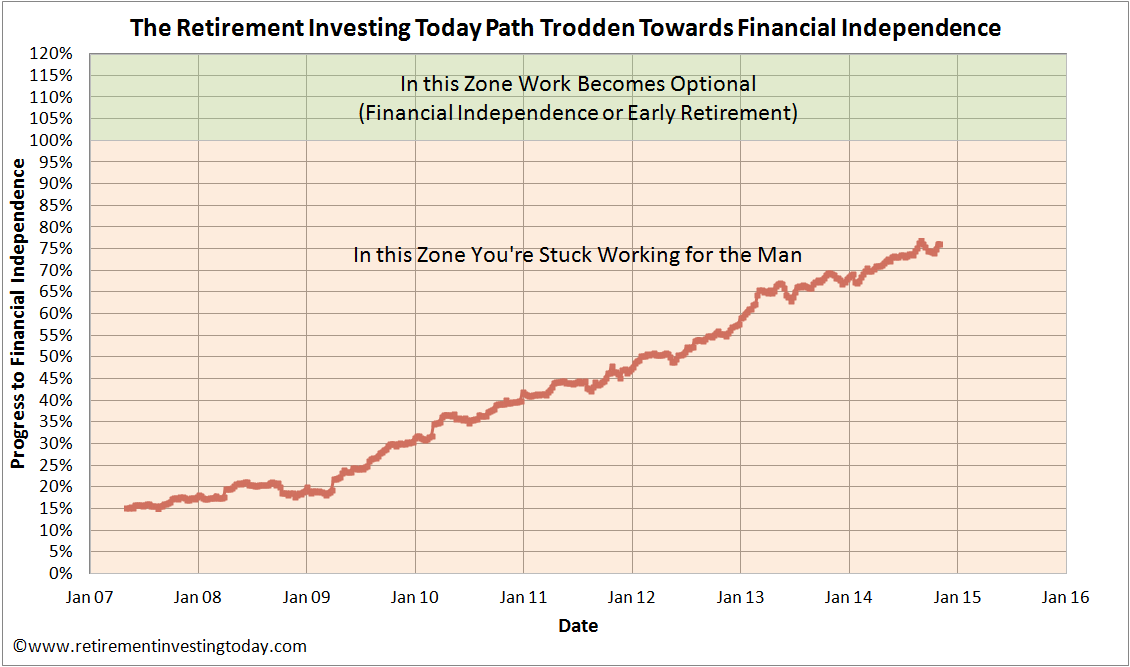

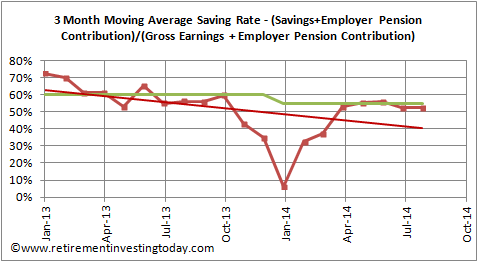

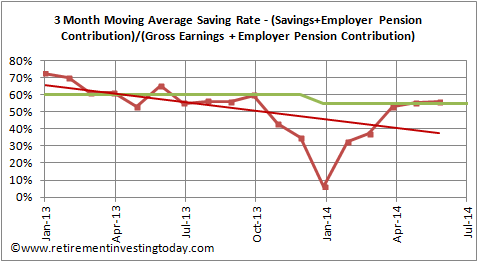

For anyone seeking Early Financial Independence, giving the option of Early Retirement, finding methods to increase earnings is extremely important. Importantly this does not have to mean increasing your day job earnings but instead can involve a new business, a second job, a side hustle, even selling stuff you no longer need now that you’ve opted out of consumerism so think creatively. So why is it important? I believe there are 3 elements to reaching the Financial Independence – generating cash savings, investing those savings to gain a return and then understanding how much wealth you need to accrue and how to manage it before calling it a day.

The Private Sector is fairing a little better than average and has kept pace with inflation having risen by 2.1%. Austerity does look to be biting the public sector though with increases of 0.8% which is well below inflation.

The chart below shows the wider real adjusted for inflation UK earnings story. The summary is pretty simple – real UK earnings for both the public and private sectors are still well below those of 2007 to 2009. Though is that a sustainable uptick I can start to see beginning to occur before me? Given what I’ve said above I’m not convinced.

Click to enlarge

For anyone seeking Early Financial Independence, giving the option of Early Retirement, finding methods to increase earnings is extremely important. Importantly this does not have to mean increasing your day job earnings but instead can involve a new business, a second job, a side hustle, even selling stuff you no longer need now that you’ve opted out of consumerism so think creatively. So why is it important? I believe there are 3 elements to reaching the Financial Independence – generating cash savings, investing those savings to gain a return and then understanding how much wealth you need to accrue and how to manage it before calling it a day.