Here on Retirement Investing Today I talk about a lot of different themes and learnings. As I learn I also then update some of those themes from time to time. This might make it sound like my financial life is complicated and full of tinkering. It’s actually the opposite of that and actually requires very few decisions on a monthly basis. This is partly because the themes I write about cover the complete spectrum of my past, present and future investing life and partly because 8 years into this FIRE journey I now know (I hope) what I'm doing. Let me demonstrate using November 2015 as an example.

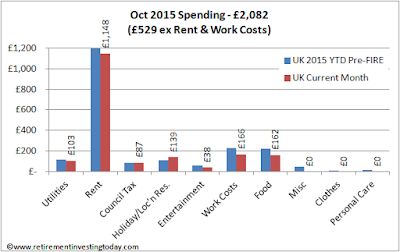

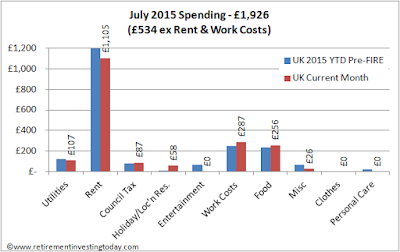

On the Spending front history tells me that because I'm a lightweight consumer I don’t need to budget. So I don’t. For any purchase I do however still mentally ask myself do I really need this, can I buy less of it and is this giving me the best value for money. Roll that into November and it resulted in 36 purchases with the lowest purchase being £1.70 for a work lunch and the highest being £1,148 for rent. After rent and work costs (my tracked metric as this is what will be relevant in FIRE) my spending was well in control at £430 for the month. This reinforces yet again that I don’t need to start budgeting.

My wealth is currently spread as follows:

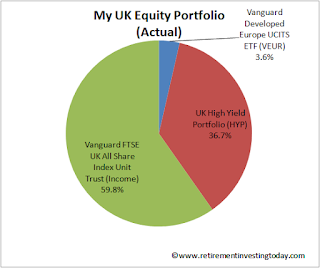

My Wealth spreadsheet tells me that against plan my Equities are positioned as follows:

On the Spending front history tells me that because I'm a lightweight consumer I don’t need to budget. So I don’t. For any purchase I do however still mentally ask myself do I really need this, can I buy less of it and is this giving me the best value for money. Roll that into November and it resulted in 36 purchases with the lowest purchase being £1.70 for a work lunch and the highest being £1,148 for rent. After rent and work costs (my tracked metric as this is what will be relevant in FIRE) my spending was well in control at £430 for the month. This reinforces yet again that I don’t need to start budgeting.

Click to enlarge, RIT November 2015 Spending

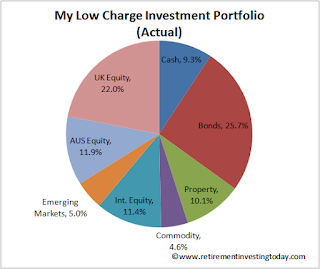

My wealth is currently spread as follows:

Click to enlarge, RIT Low Charge Investment Portfolio

My Wealth spreadsheet tells me that against plan my Equities are positioned as follows:

- International Equities are 20.4% underweight

- UK Equities are 14.6% underweight

- Emerging Markets are 10.2% underweight; and

- Australian Equities are well overweight as in hindsight this was a mistake that I now can’t correct so will just let sit and spin off dividends ‘forever’.