However, this is not what is making things memorable. That’s coming from me slowly realising that because my FIRE strategy makes me an outlier it also makes me vulnerable and exposed rather than invincible. This was nicely demonstrated by the Brexit vote. As a ‘young’ retiree looking to head to The Mediterranean within a year I’m sure it doesn’t take a genius to guess that I voted Remain in the Brexit referendum. If everyone else had have been on my trajectory that would have been the result. Instead my demographic had no influence, as the numbers of people looking to FIRE to The Med are probably not much more than one, so democracy took over and we ended up with Leave for many other reasons. So far that result has resulted in pound devaluation (which on its own I could have coped with) but also discussions of Hard Brexit which has turned my plans from 95% The Med to 50%. I’m a minority affected by politics and populism and because I’m not part of a significant demographic my vote just won’t make a difference. What if the next populist democratic step is to start taxing capital and providing relief to the indebted... We’re almost there via interest rates anyway but what if it becomes an overt policy...

Sunday 16 October 2016

9 months into 2016 – The plans they are a-changin’

However, this is not what is making things memorable. That’s coming from me slowly realising that because my FIRE strategy makes me an outlier it also makes me vulnerable and exposed rather than invincible. This was nicely demonstrated by the Brexit vote. As a ‘young’ retiree looking to head to The Mediterranean within a year I’m sure it doesn’t take a genius to guess that I voted Remain in the Brexit referendum. If everyone else had have been on my trajectory that would have been the result. Instead my demographic had no influence, as the numbers of people looking to FIRE to The Med are probably not much more than one, so democracy took over and we ended up with Leave for many other reasons. So far that result has resulted in pound devaluation (which on its own I could have coped with) but also discussions of Hard Brexit which has turned my plans from 95% The Med to 50%. I’m a minority affected by politics and populism and because I’m not part of a significant demographic my vote just won’t make a difference. What if the next populist democratic step is to start taxing capital and providing relief to the indebted... We’re almost there via interest rates anyway but what if it becomes an overt policy...

Saturday 8 October 2016

Post financial independence, post Brexit, what next

|

| FIRE in Cyprus? |

I’ve started to call the first the blogs that are selling a life and the second the blogs that are living a life. I’ve also pretty much stopped reading the former as they no longer resonate with me as my journey has and continues to be much more like the second type. If you however prefer the first type then I’d suggest you move onto your next piece of Saturday reading as this post will likely disappoint.

I’m now coming up on 3 months of financial independence (FI) and the one thing I’ve been trying to leave via FIRE (financially independent retired early), work, has already become a very different place. My workplace and the career I chose is one that is very focused on the financial top and bottom lines. This means that it’s no secret that as soon as my job can be done by somebody else cheaper or more efficiently in the world then I won’t have a job. It’s also one where if you perform well you can do well financially, and I have, but also one where even average performance will result in you quickly finding yourself without a job. For me this has helped with my rapid progress to FI (of course it’s taken a number of other choices as well) but it’s come with the sword of Damocles always in full view. 3 months ago that sword was taken away and it’s made a big difference. It’s firstly just simply removed a weight from my shoulders as out sourcing or average performance will now just result in a nice pay off, which I negotiated some time ago when I seriously looked to move on but was still a golden child, which will further bolster my wealth nicely and result in me simply sailing off into the FIRE sunshine. Additionally, to ensure continuous success one technique I’ve used over the years is to work very hard which gives me extra time to drive the risk out of every decision I make. The ramifications of this are pretty long days but it did help with surety of tenure. Since FI I’ve started to take now take more risk as there are now no downsides personally. So far this has me back to peak performance, having dipped for a few months following extra work load, but I’m also working slightly less hours and that 0.5 – 1 hour less work per day has put a spring back in my step. It’s still not the place I’d choose to be Monday to Friday and FIRE is still very much in view but it’s a lot better post FI then pre.

Saturday 24 September 2016

Checking my credit report (and it’s not great news)

From the fortunate position I currently find myself it’s unlikely I’ll ever need or want to take on any form of debt ever again. That said I’m also a plan for the worst just in case kind of guy. Incidentally, the end result of which is usually a nice upside surprise but you just never know.

So with this in mind I decided to finally, having never checked it previously, check in on my credit report and score. I used noddle.co.uk as its ‘free for life’ but there are a few of them out there including Experian and Equifax who offer free 30 day trials. Just don’t forget to unsubscribe with those or you could be paying up to £14.99 per month for every month you forget. Not an insignificant amount.

If I’m being honest I was expecting a nice credit worthiness upside and the actual result surprised me somewhat. So let’s look at what they have on me:

So with this in mind I decided to finally, having never checked it previously, check in on my credit report and score. I used noddle.co.uk as its ‘free for life’ but there are a few of them out there including Experian and Equifax who offer free 30 day trials. Just don’t forget to unsubscribe with those or you could be paying up to £14.99 per month for every month you forget. Not an insignificant amount.

If I’m being honest I was expecting a nice credit worthiness upside and the actual result surprised me somewhat. So let’s look at what they have on me:

- Personal Information. They have my date of birth and history of addresses.

- Financial Account Information. They have my American Express Platinum Cashback credit card which shows a long and perfect history of repayment as I direct debit full payment every month. They show my current account but have no record of my cash savings accounts. Unfortunately they also show a store card with a missed payment of £4 which is not even mine. I’ve disputed that which they say can take 28 days to resolve. So checking my credit report has already been of value.

- Short Term Loans. I positively get “YOU HAVE NO OPEN SHORT TERM LOAN ACCOUNTS ON YOUR REPORT.”

- Electoral Roll. I’m showed as being registered and the details are correct.

- Public Information. I positively get “YOU HAVE NO BANKRUPTCIES OR INSOLVENCIES RECORDED ON YOUR REPORT” and “YOU HAVE NO JUDGEMENTS RECORDED ON YOUR REPORT.”

- CIFAS (the UK’s Fraud Prevention Service). I positively get “THERE ARE NO CIFAS WARNINGS REGISTERED AT YOUR ADDRESS(ES).”

Saturday 10 September 2016

Rearranging my YouInvest SIPP

I have had a YouInvest (formerly Sippdeal) SIPP (Self Invested Personal Pension) wrapper since 2011. It came about when I first started transferring expensive insurance company based Stakeholder and Group Personal Pensions across to SIPP’s to save on expenses. Over the years this SIPP has grown steadily to become a significant portion of my wealth as it now contains circa £200,000.

I have had a YouInvest (formerly Sippdeal) SIPP (Self Invested Personal Pension) wrapper since 2011. It came about when I first started transferring expensive insurance company based Stakeholder and Group Personal Pensions across to SIPP’s to save on expenses. Over the years this SIPP has grown steadily to become a significant portion of my wealth as it now contains circa £200,000.Within the YouInvest SIPP I was holding the following three investment products:

- The Vanguard FTSE U.K. All Share Index Unit Trust with annual expenses of 0.08%;

- The Vanguard U.K. Inflation-Linked Gilt Index Fund with annual expenses of 0.15%; and

- The iShares European Property Yield UCITS (IPRP) with annual expenses of 0.4%.

For the privilege of using the YouInvest SIPP wrapper I was also paying annual expenses of £300 which was coming in the form of:

- A YouInvest SIPP custody charge of £25 per quarter as my SIPP value was greater than £20,000; and

- A YouInvest Funds (Unit trusts and OEICs) charge of 0.2% per annum but which was capped at a maximum of £50 per quarter

Life was good and even though I didn’t like paying the £300 per annum I didn’t do anything about it as to correct it I would have had to be out of the market and might lose significantly more than I gained. That was until I received a notification from YouInvest in early August 2016 that they were intending to change their charging structure from the 01 October 2016 which included a great reason [sic] for the change – “We believe this will be easier to understand, whilst maintaining AJ Bell’s commitment to offering some of the lowest charges in the market.”

Saturday 3 September 2016

Can you afford to not DIY invest

Grant Thornton has completed some research (free FT link or Google “How much do you really pay your money manager?”) which concludes that someone entrusting £100,000 for 10 years to a UK financial adviser or investment manager would pay an average 2.56% annually for financial planning services and financial product expenses. Let’s look at what that might mean during both the wealth accumulation and drawdown (assuming no annuity is purchased) phases of a typical investor.

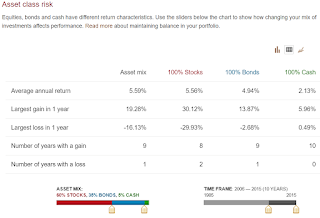

Unfortunately, the Vanguard LifeStrategy funds have only been around 5 years or so which isn’t enough time to use for this study as I need 10 years (or so) of data. Vanguard does however have an interesting Asset class risk tool (h/t diy investor (uk))which allows you to input a period and an asset allocation. Let’s create a reasonably balanced portfolio with 60% stocks, 35% bonds and 5% cash and run for a period of 10 years.

The result is an average annual investment return of 5.59%. So with this return what does our investor have left after a few subtractions. Firstly, let’s subtract the erosion caused by inflation. The RPI has averaged 2.87% over the last 10 years. Subtracting that gives us a real return of 2.72%. Now let our money manager and the investment products s/he is peddling take their cut of 2.56%. Oops our real return is now 0.16%. Looking at it another way our average money manager/investment product provider is taking 94% of our real return, leaving us with 6% only, which is hardly conducive to long term wealth building. It also gets worse as that will be before portfolio turnover costs, taxes and trading costs to name but three. After those we’ve probably nearly done no better, or maybe even worse, than matching inflation which might mean we’re actually even going backwards.

Wealth accumulation phase

When it comes to investment return, excluding expenses, I believe that active investing is a zero sum game resulting in average performance no better than that of the market average. Of course there will be some winners and some losers, particularly in the short term, but that’s for another day. Today let’s therefore assume that the investment return these money managers achieve is that of the market. Let’s look at a couple of possible portfolios.Unfortunately, the Vanguard LifeStrategy funds have only been around 5 years or so which isn’t enough time to use for this study as I need 10 years (or so) of data. Vanguard does however have an interesting Asset class risk tool (h/t diy investor (uk))which allows you to input a period and an asset allocation. Let’s create a reasonably balanced portfolio with 60% stocks, 35% bonds and 5% cash and run for a period of 10 years.

Click to enlarge, 10 year time frame, 60% stocks (FTSE UK All Share Total Return Index), 35% bonds (FTSE British Govt. Fixed All Stocks Total Return Index (1983 - 2013) and BarCap Sterling Aggregate Total Return Index), 5% cash (LIBOR 3-month average over the year)

The result is an average annual investment return of 5.59%. So with this return what does our investor have left after a few subtractions. Firstly, let’s subtract the erosion caused by inflation. The RPI has averaged 2.87% over the last 10 years. Subtracting that gives us a real return of 2.72%. Now let our money manager and the investment products s/he is peddling take their cut of 2.56%. Oops our real return is now 0.16%. Looking at it another way our average money manager/investment product provider is taking 94% of our real return, leaving us with 6% only, which is hardly conducive to long term wealth building. It also gets worse as that will be before portfolio turnover costs, taxes and trading costs to name but three. After those we’ve probably nearly done no better, or maybe even worse, than matching inflation which might mean we’re actually even going backwards.

Subscribe to:

Posts (Atom)