Unless you’re one of the lucky ones sitting on a defined benefit pension (although it’s likely you’ll also need some other income source in the early years if you’re going to FIRE) or you intend to buy an annuity (again, not likely for the early years of FIRE) or you’re just planning on living off the State Pension then income drawdown in FIRE (or even just plain old retirement) is relevant.

This is the annual update of a series of drawdown demonstrations that are now some 9.5 years in. To put this in perspective we are now within a whisker of one third of the way through the period that the 4% rule is based upon and this simulation assumes retirement was taken on the 31 December 2006. If this date sounds convenient then you’re right. The date was deliberately chosen as it is the year prior to the commencement of the global financial crisis and so hopefully represents a modern worst case. Someday it may even go down in history as one of the time periods which saw a poor sequence of returns however of course that will only become clear when we are firmly looking in the rear view mirror many years hence.

Over the years readers have suggested various alternatives for these demonstration portfolios however for long term consistency I want to make as few changes to the original assumptions as possible so will stick with them for now.

Where we left our retiree’s last year can be found here. In brief, the key assumptions are:

I always start with a 4% withdrawal rate because of the often quoted 4% safe withdrawal rate rule. The 50% equity : 50% gilts portfolios (the red lines on the chart) are the closest representations to the 4% rule with obvious differences being that:

This is the annual update of a series of drawdown demonstrations that are now some 9.5 years in. To put this in perspective we are now within a whisker of one third of the way through the period that the 4% rule is based upon and this simulation assumes retirement was taken on the 31 December 2006. If this date sounds convenient then you’re right. The date was deliberately chosen as it is the year prior to the commencement of the global financial crisis and so hopefully represents a modern worst case. Someday it may even go down in history as one of the time periods which saw a poor sequence of returns however of course that will only become clear when we are firmly looking in the rear view mirror many years hence.

Over the years readers have suggested various alternatives for these demonstration portfolios however for long term consistency I want to make as few changes to the original assumptions as possible so will stick with them for now.

Where we left our retiree’s last year can be found here. In brief, the key assumptions are:

- Our retiree’s are drawing down at the stated withdrawal rate plus fund expenses only. This means any trading commissions, wrapper fees (eg ISA, SIPP fees), buy/sell spreads and taxes have to be paid out of the earnings taken. For example, our 2% initial withdrawal rate retiree is actually drawing down at between 2.1% and 2.2% dependent on the asset allocation selected.

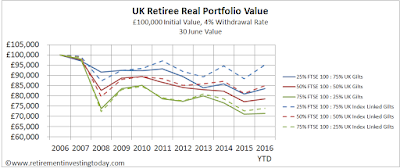

- 6 Simple UK equity / UK bond portfolios are simulated for our retiree. The UK equities portion is always the FTSE 100 where the iShares FTSE 100 ETF (ISF) is used as the proxy. This fund currently carries expenses of 0.07% however this has been as high as 0.4% in the past. For the bonds portion a simulation is run against UK gilts (FTSE Actuaries Government Securities UK Gilts All Stock Index) where the iShares FTSE UK All Stocks Gilt ETF (IGLT) is used as the proxy and the bond type I have preferred in my own portfolio, UK index linked gilts (Barclays UK Government Inflation-Linked Bond Index), where the iShares Barclays £ Index-Linked Gilts ETF (INXG) is used as the proxy.

- All calculations are in real (RPI inflation adjusted) terms meaning that a £ in 2006 is equal to a £ today.

- The wealth accrued at retirement (the 31 December 2006) is £100,000. To simulate a larger or smaller amount of wealth just multiple by a constant. For example if you want our retiree’s to have £600,000 just multiply all the subsequent pound values by 6.

A 4% Initial Withdrawal Rate

UK Retiree Real Portfolio Value, £100,000 Initial Value, 4% Withdrawal Rate, 30 June Value, Click to enlarge

I always start with a 4% withdrawal rate because of the often quoted 4% safe withdrawal rate rule. The 50% equity : 50% gilts portfolios (the red lines on the chart) are the closest representations to the 4% rule with obvious differences being that:

- the 4% rule was for a US based investor with US based investments while I’m simulating UK investors with UK based investments; and

- the 4% rule doesn’t consider fees where I’m capturing the OCF’s of the ETF’s which makes my withdrawal rate very slightly higher.