As always before we look at the CAPE let us first look at other key FTSE 100 metrics:

- The FTSE 100 Price is currently 6,104 which is a gain of 4.0% on the 03 December 2012 Price of 5,871 and 7.1% above the 02 January 2012 Price of 5,700.

- The FTSE 100 Dividend Yield is currently 3.64% which is a little down against the 03 December 2013 yield of 3.73%.

- The FTSE 100 Price to Earnings (P/E) Ratio is currently 11.78.

- The Price and the P/E Ratio allows us to calculate the FTSE 100 As Reported Earnings (which are the last reported year’s earnings and are made up of the sum of the latest two half years earnings) as 518. They are up 1.1% month on month but down 6.5% year on year. The Earnings Yield is therefore 8.5%.

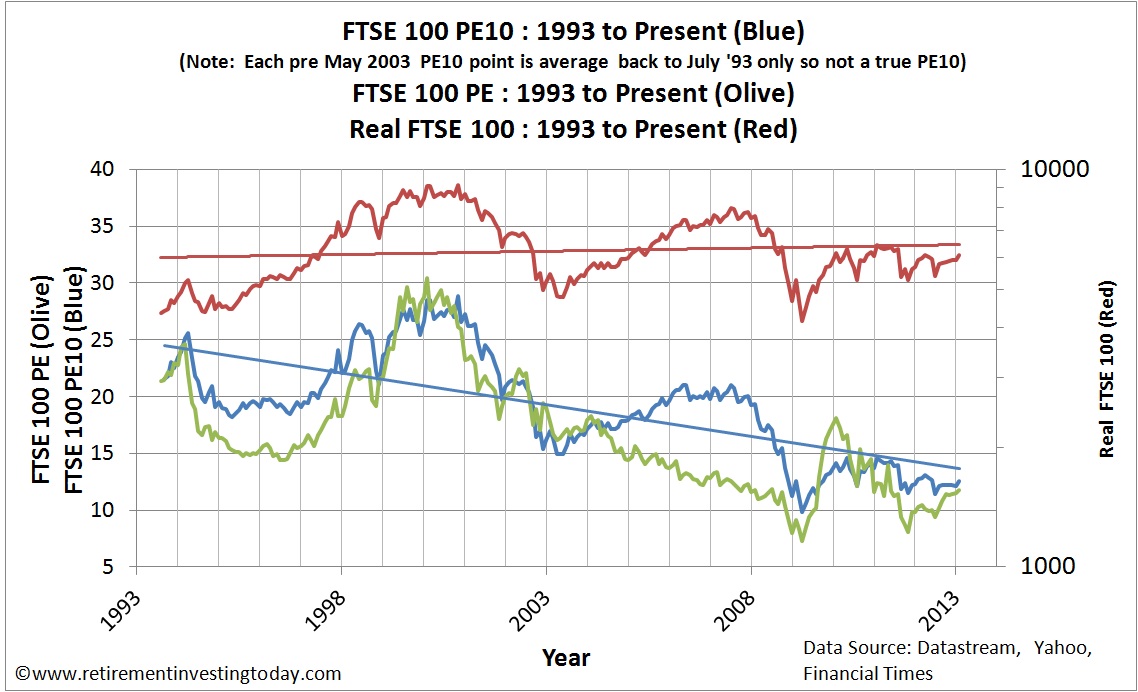

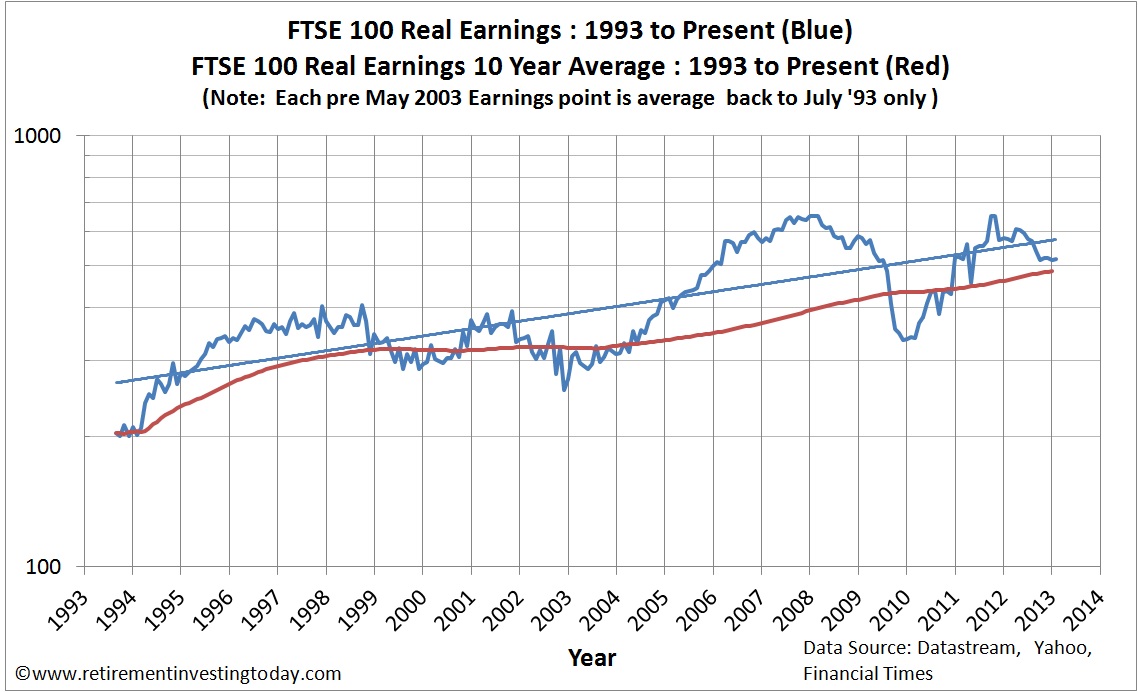

The first chart below provides a historic view of the Real (CPI adjusted) FTSE 100 Price and the Real FTSE 100 P/E. Look at the trend line of the Real Price. After you strip out the effects of inflation the perceived market value is doing not much more than oscillating above and below a flat line. This then presents a problem for any buy and holder reinforcing the importance of dividends. The second chart provides a historic view of the Real Earnings along with a rolling Real 10 Year Earnings Average for the FTSE 100.

Click to enlarge

Click to enlarge

As always let us now turn our attention to the FTSE 100 Cyclically Adjusted PE. This is also shown in the first chart above. For completeness let me also detail the usual reminders. I do not use P/E ratio’s to make investment decisions from and instead use this CAPE. This is because the P/E ratio does not take the business cycle into account which the CAPE tries to adjust for. The method used is similar to that developed by Professor Robert Shiller for the S&P500. The calculation is the ratio of Real (ie after inflation) FTSE 100 first possible day of the month Price to the 10 Year Real (CPI adjusted) first possible day of the month Earnings. Unfortunately the dataset I have created only goes back to July 1993. Therefore to get a meaningful set of numbers I have had to average in to a PE10 for the first 10 years. What this means is that July 1994 is actually a PE1, July 1995 is a PE2 and so forth until July 2003 when we have a full FTSE 100 PE10.