Before we run the CAPE analysis let us first look at some of the key Australian Stock Market metrics:

- The ASX 200 Price at market close on Friday was 4,709 which is up 1.3% from last month’s Price of 4,649 and up 10.5% year on year.

- The MSCI Australia Dividend Yield is currently 4.6%. I accept this Index as an ASX200 proxy for both Dividend Yield and P/E Ratio based on this analysis.

- The ASX 200 Earnings (calculated using MSCI Australia P/E Ratio and ASX 200 Price) are currently 304. This gives an Earnings Yield of 6.5%.

- The MSCI Australia P/E Ratio is currently 15.5 compared with the dataset (since December 1982) average P/E of 18.3

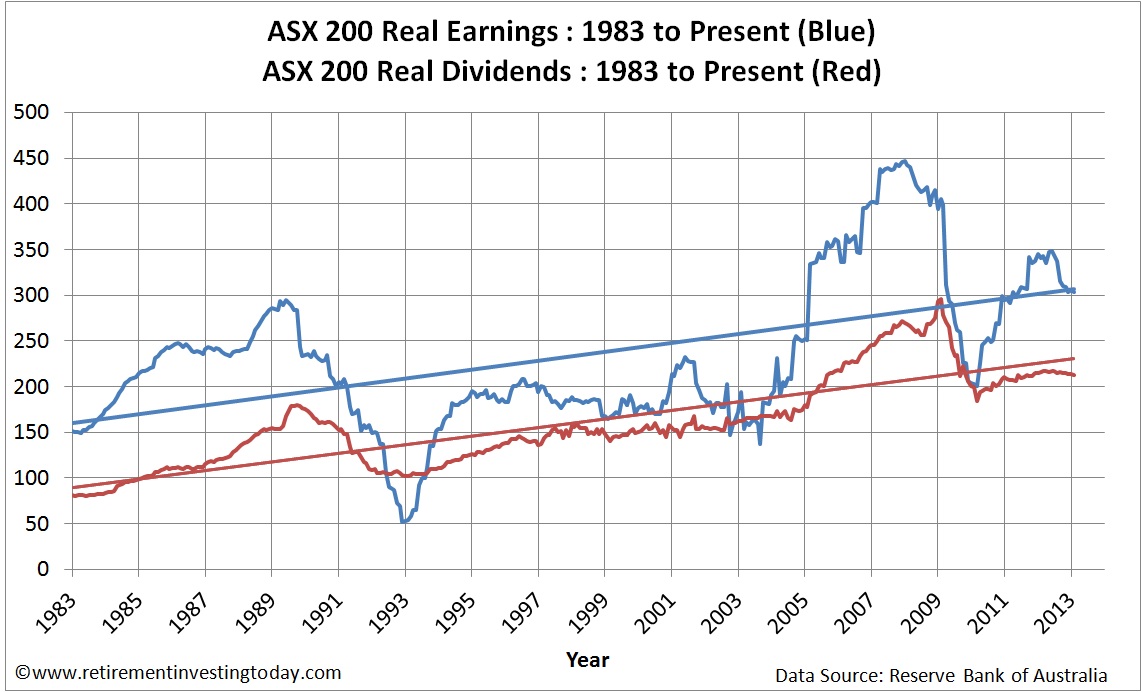

The first chart today shows a historic view of the Real (inflation adjusted) ASX 200 Price and the ASX 200 P/E. The second chart provides a historic view of the Real (after inflation) Earnings and the Real (after inflation) Dividends for the ASX 200.

Click to enlarge

Click to enlarge