As a 46 year old now in Early Retirement it seems worthwhile to now share more detail on how I have as tax efficiently as possible tried to build my wealth so that I run out of life before I run out of wealth. For some time now at a high level I’ve used the following approach, which of shared on a number of occasions, to know when to pull the trigger. Track my spending religiously then adjust that spending to add new expected retirement spends while subtracting non-retirement spends such as costs associated with work. With my retirement spending defined at £24,000 per annum I then retired when that spending was the lesser of 85% of dividends received from the portfolio or a safe withdrawal rate of 2.5%.

This sounds relatively simple but it’s actually a more complicated problem than that as I actually have my wealth and earnings sitting in four buckets which have differing rules, including the age with which I can gain access. These are:

So all in that’s wealth £1,324,000 and a government ‘promise’ of £5,353 annually at some point in the future. Let’s look at each of these in turn.

So far so good. I have enough wealth to buy a home.

This sounds relatively simple but it’s actually a more complicated problem than that as I actually have my wealth and earnings sitting in four buckets which have differing rules, including the age with which I can gain access. These are:

- £225,000 sitting in savings accounts ready for a home purchase. This is accessible now.

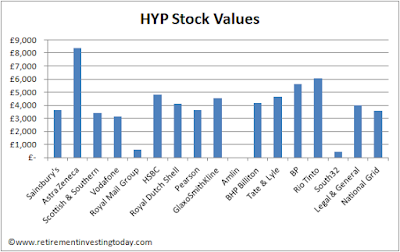

- £521,000 sitting in savings accounts, NS&I index linked savings certificates (ILSC’s) as well as bonds, gold, listed property and equities within trading account and ISA wrappers. This is also accessible now.

- £578,000 sitting in bonds, gold, listed property and equities within pension wrappers. This currently cannot be accessed until age 55.

- A State Pension promise according to my latest forecast of £5,353 per annum. The current government promise is this is accessible at age 67.

So all in that’s wealth £1,324,000 and a government ‘promise’ of £5,353 annually at some point in the future. Let’s look at each of these in turn.

£225,000 Home Purchase

We are currently renting but intend to buy and the money sitting in savings accounts ready for the purchase has no access restrictions. The risk I carry here is if house prices rise at a rate greater than the interest after tax I can earn then I’m losing housing opportunity. If my interest after tax is greater then I’m winning. I see this approach as a less risk than if I invested this wealth into bonds, listed property or equities as the likely erosion should be gradual when compared to what bond and equity markets can do over a relatively short period. That said I don’t want to wait too long. From where I sit today there are no negatives to buying as if house prices fall we still have the home where if they rise we are losing quality of life that will come from our dream home. We’ll therefore be buying as soon as we find a region to call home. That might be Cyprus but we won’t know that for a few more months.So far so good. I have enough wealth to buy a home.