So you’ve decided that you would like to try and gain some volatility versus return free lunch via some Bonds mixed in with your Equities or Equities mixed in with your Bonds. The next million dollar question to answer is then how much of your wealth should be allocated to each asset class. This is a critical question as it will likely have a big affect on your long term portfolio return.

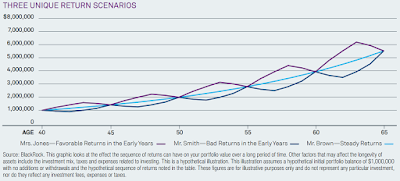

Unfortunately, as with many investing questions, I'm yet to find a silver bullet but considerations will certainly include your tolerance to volatility and risk. Assessing this tolerance is of course easier said than done. For example if you’re naturally risk averse you might choose to load up with more bonds as history suggests they might dampen volatility at the expense of some return however this adds absolutely no value if you then have a low probability of ever achieving your long term goal. Conversely there is then no point loading up with more equities to then sell at the first significant equity downturn. On top of this there could also be age considerations. For example every year that passes gives you less time to rebuild wealth before retirement.

So what do others have to say about bond to equity allocation percentages?

The granddaddy of value investing, Benjamin Graham, in his excellent first published in 1949 revised multiple times book, The Intelligent Investor , says “We have already outlined in briefest form the portfolio policy of the defensive investor. He should divide his funds between high-grade bonds and high-grade common stocks. We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums. According to tradition the sound reason for increasing the percentage in common stocks would be the appearance of the “bargain price” levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgement of the investor the market has become dangerously high.”

, says “We have already outlined in briefest form the portfolio policy of the defensive investor. He should divide his funds between high-grade bonds and high-grade common stocks. We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums. According to tradition the sound reason for increasing the percentage in common stocks would be the appearance of the “bargain price” levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgement of the investor the market has become dangerously high.”

Unfortunately, as with many investing questions, I'm yet to find a silver bullet but considerations will certainly include your tolerance to volatility and risk. Assessing this tolerance is of course easier said than done. For example if you’re naturally risk averse you might choose to load up with more bonds as history suggests they might dampen volatility at the expense of some return however this adds absolutely no value if you then have a low probability of ever achieving your long term goal. Conversely there is then no point loading up with more equities to then sell at the first significant equity downturn. On top of this there could also be age considerations. For example every year that passes gives you less time to rebuild wealth before retirement.

So what do others have to say about bond to equity allocation percentages?

The granddaddy of value investing, Benjamin Graham, in his excellent first published in 1949 revised multiple times book, The Intelligent Investor