I am still yet to buy myself a flat or house even though the ownership of one is important to my retirement investing strategy in the longer term. As I mentioned last month I have now also even stopped looking on the internet at house prices in the area that I am interested as I still think that UK house prices are still overvalued by a huge margin. Today the Nationwide reported that average house prices had risen from £161,320 to £164,519, a monthly rise of £3,199 or 2.0%. On an annualised basis house prices in absolute terms are up by 9.0% and if I look at real (after inflation) returns they are still up by 4.5%. When you live in a society where average assets are increasing at £3,199 per month I ask myself why go to work. Why not just leverage up, buy a few buy to lets and sit at home using your house price increases as a cash machine [sic].

Showing posts with label house prices. Show all posts

Showing posts with label house prices. Show all posts

Tuesday 30 March 2010

Monday 29 March 2010

Australian house price anecdotal

My dataset for Logan City which is just south of Brisbane shows that over the last 3 months house prices have risen 4.6% in this part of the world. This seems outrageous to me given the credit crunch that the world has just been through. However I now have a story that I wouldn’t have believed if somebody had told me but that demonstrates just how crazy the property market still is in this part of the world.

Wednesday 10 March 2010

Australian Property Market (Alternate Data) – February 2010 Update

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.

Wednesday 3 March 2010

Winners and losers of recent government and Bank of England decisions – workers and homeowners

Picking up on Monday’s theme I’d like to have a look at two further winners or losers of the current governments and Bank of England’s decisions. This time is workers and homeowners. One is a winner and the other is a loser. Can you guess who is who? My chart today reveals all.

Firstly let me just benchmark inflation. The retail prices index – RPI, which is represented by the olive line, is current year on year running at 3.7% and since 1991 the arithmetic average of the monthly year on year percentages has been 3.5%. Of interest also is that the inflation trendline is heading in a downwards direction.

Firstly let me just benchmark inflation. The retail prices index – RPI, which is represented by the olive line, is current year on year running at 3.7% and since 1991 the arithmetic average of the monthly year on year percentages has been 3.5%. Of interest also is that the inflation trendline is heading in a downwards direction.

Tuesday 2 March 2010

UK Mortgage Rates and Approvals – March 2010 Update

Two in my opinion very interesting and somewhat conflicting charts today. The first picks up on yesterday’s theme by showing the monthly interest rate of UK resident banks and building societies sterling standard variable rate mortgage to households (not seasonally adjusted) and highlights that for this data set rates remain at near record lows at 3.97% (actual low was 3.82% in April 2009). Compare this with CPI of 3.4% and RPI of 3.7% and my comments of yesterday.

Sunday 28 February 2010

UK Property Market – February 2010 Update

I am still yet to buy myself a flat or house even though the ownership of one is important to my retirement investing strategy in the longer term. I have now for the time being even stopped looking on the internet at house prices in the area that I am interested. The reason for this is that in my opinion UK house prices are still overvalued by a huge margin. Last week the Nationwide reported that average house prices had fallen from £163,481 to £161,320, a monthly fall of £2,161 or 1.3%. On an annualised basis house prices in absolute terms are still up annually by 9.2% and if I look at real (after inflation) returns they are still up by 6%.

I am still yet to buy myself a flat or house even though the ownership of one is important to my retirement investing strategy in the longer term. I have now for the time being even stopped looking on the internet at house prices in the area that I am interested. The reason for this is that in my opinion UK house prices are still overvalued by a huge margin. Last week the Nationwide reported that average house prices had fallen from £163,481 to £161,320, a monthly fall of £2,161 or 1.3%. On an annualised basis house prices in absolute terms are still up annually by 9.2% and if I look at real (after inflation) returns they are still up by 6%.Saturday 20 February 2010

“How Lloyds TSB is helping first time buyers”

I was amazed but unfortunately not surprised to see the methods that Lloyds TSB (which is being propped up by my taxes) is using to try and cajole first time buyers into the UK housing market. The product being peddled justified a four page advertisement in a major London newspaper and is called the Lend a Hand Mortgage.

I was amazed but unfortunately not surprised to see the methods that Lloyds TSB (which is being propped up by my taxes) is using to try and cajole first time buyers into the UK housing market. The product being peddled justified a four page advertisement in a major London newspaper and is called the Lend a Hand Mortgage.The advertisement starts with “as a response to the current market conditions, the Lend a Hand Mortgage is giving first time buyers the opportunity to get help with their mortgage from family and friends.” From what I read it doesn’t look like that great a deal to me.

Lloyds claim that “in 1999, 592,000 first time buyers completed mortgages, by last year it had fallen to 193,000, according to the Council of Mortgage Lenders,” My chart today demonstrates clearly one of the big drivers of why this has occurred. For the year 1999 the ratio of Nationwide Historical House Prices to the Average Earnings Index (LNMM) was an average 742.7 and in 2009 this had risen to 1139.1. That means affordability has reduced by 53%. This un-affordability has been caused by the very same banks that are creating products like that advertised extending ever easier credit which is what put us in the current mess we are in today.

The mortgage advertisement goes on to say “even as recently as a couple of years ago, it was much easier to get a mortgage... and it was not uncommon to get a 100% mortgage that didn’t need a deposit.” As we all now know that was just foolish. I’m still amazed this occurred. If you can’t put together a deposit for a mortgage just how did the banks expect people to be able to afford to repay that mortgage. Additionally the banks were counting on property never decreasing in value plunging people into negative equity. Even the most naive banker by spending 10 minutes on the internet could have found historical data that showed how false this assumption was.

Some more data provided in the mortgage advertisement states that “according to the Council of Mortgage lenders, in July last year 80% of first time buyers were turning to their parents for help, up from 50% in February.” To have included this Lloyds clearly think that this adds to the sell. What’s it saying? Everyone else is doing so you should to? Personally I find that a terrible statistic and quite sad. House prices are so over valued compared to earnings that it is almost impossible for a first home buyer to buy a roof to put over their heads without external support. Basic human needs are food, clothing and shelter. Now we are in a situation where one of the basic human needs is now unobtainable without support. What type of country are we living in?

So how does this product work? Let’s say you want to buy a house for £100,000. As the first home buyer you offer up 5% (£5,000) worth of deposit and your ‘helper’ offers up 20% (£20,000) which is placed in a savings account earning rate of 4.15% for 42 months. Then by magic the first home buyer is able to be given a mortgage of 95% (£95,000) at 5.69% fixed until March 2013 if you don’t pay a product fee (whatever that is). Let’s analyse this a little:

- The ‘helper’ gets their money back after 42 months “provided the buyer doesn’t default on their mortgage payments, and provided the amount of the mortgage compared to the value of the property (LTV) has dropped to 90% or less – as assessed by us...” So Lloyds have cleverly protected themselves from a house price crash of up to 25% for the next 3.5 years by effectively offering a 75% mortgage.

- Should Lloyds have only offered first home buyers the 75% mortgage it would have meant that a £5,000 deposit could have only secured a mortgage of £15,000. Instead, this scheme can leverage the first home buyer up to a mortgage of £95,000 while providing some protection to themselves.

- The mortgage is a repayment mortgage however to demonstrate quickly how much this mortgage benefits Lloyds I’m going to assume an interest only mortgage (ie no principle is repaid). Both final amounts I’ll present would be a little less if calculated as a repayment mortgage although not by much as the principle reduction per year is very small in the early years of a mortgage. Let’s look at what happens in the first year. So the buyer who takes a standard 75% mortgage provides Lloyds with charges of approximately £15,000 x 5.69% = £853.50. Now the buyer who takes a ‘Lend a Hand’ provides Lloyds with charges of approximately £75,000 x 5.69% + £20,000 x (5.69%-4.15%) = £4,575.50.

To me it looks like a continuation of the past:

- The first home buyer ends up over leveraged and indebted for life which is what put us into the credit crunch in the first place.

- Lloyds ends up squeezing more than 5 times the revenue out of the same customer.

The only difference is that this time Lloyds are a bit cleverer and give themselves some more protection than previous times.

I’m not convinced the product is designed to give “more people...a chance to own their first home” more likely a chance for Lloyds to maximise its revenues. I’m remaining out of the house market for now and the more I read about these types of products the more I think current prices are unsustainable.

As always DYOR.

Wednesday 10 February 2010

UK House Price Thoughts

As part of my retirement investing strategy at some point I need to buy a house. As I have mentioned before I am not currently buying as I believe house prices are overvalued.

As part of my retirement investing strategy at some point I need to buy a house. As I have mentioned before I am not currently buying as I believe house prices are overvalued.I have been looking for a data set that would show me when average interest rates charged by the banks for house mortgages were starting to rise. I was also looking for a measure that would show increases fairly quickly rather than waiting for lots of old fixed rate mortgages to expire. I thought I had found a good measure and started to see rates rising by using UK resident banks interest rates of new loans secured on dwellings to households when I blogged here.

I’ve been thinking about what loans secured on dwellings means and it seems likely that it includes a lot more than mortgages. I’ve had another trawl through the Bank of England web site and found a data set that should be certainly showing very recent changes to mortgage interest rates and might be more appropriate to use. This data set is the monthly interest rate of UK resident banks and building societies sterling standard variable rate mortgage to households not seasonally adjusted (data set IUMTLMV). A chart of this is shown above. Unfortunately, unlike the previous ‘secured on dwellings’ data set variable rates are still at lows of around 4% having been as high as 8.87%. So unfortunately for those (including me) waiting for increasing mortgage rates to potentially reduce house affordability it appears we have a while to wait yet.

On a more positive note it’s not all good news for house prices. Firstly, as reported by the Financial Times lenders “have warned that they will have to slash mortgage lending and raise rates on home loans if the government insists on prompt and full repayment of the £300 billion they have received in state support since 2008”. This is linked to the Special Liquidity Scheme and the Credit Guarantee Scheme which must be repaid by 2012 and 2014. So the banks are back to big profits and big bonuses yet they can’t give the government back the money they have borrowed. That money is my taxes we are talking about. If they can pay bonuses they should be repaying their loans like everyone else. The article goes on to say that the “lenders cannot retain their existing loan books and still make new ones while access to wholesale funds is as limited as it is” and continues with “retail deposits, which are considered far more stable and which bank regulators are encouraging lenders to rely on more heavily as a source of funds for new lending, simply cannot grow quickly enough to make up for the wholesale funds that are being withdrawn.”

Here’s an out of the box idea. How about the government lets the market operate freely rather than distort it with all this intervention. So where do the banks then get their money from? Another ‘crazy’ idea. How about they start paying interest rates on savings that are above inflation and that will encourage people to start saving again. Oh that’s right, that would then force mortgages up and maybe bring house prices back to more sensible levels. Let’s see if the government after the next election gives in to the banks demands.

Secondly, the Financial Times also reports that estate agents have seen the first drop in new buyer enquiries for 14 months. Is this a genuine fall or due to the cold weather that we have been happening? I guess it will all show up in the house price figures in due course.

As always DYOR

Monday 8 February 2010

Australian Property Market (Alternate Data) – February 2010 Update

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.

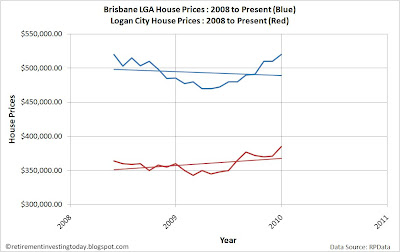

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.I’m therefore looking for something that helps me keep my finger on the pulse a little more. Certainly monthly figures are desirable. I am going to therefore use housing data published by RPData and in particular I will monitor the Brisbane and Logan City numbers.

The ABS published their quarterly data to December 2009 on Monday. This chance only comes every 3 months and so it is interesting to compare the ABS data with the alternate monthly dataset that I am using from RPData which is shown in the above chart. The ABS shows that for the quarter to December 2009 Brisbane prices have risen by 3.8% with a year on year increase of 10.9%. Remember the ABS reports median prices for detached properties only.

In contrast from RPData I am using what are called recent median house sale prices so I would expect similar data. For Brisbane the data shows increases for the quarter to December 2009 of 5.9% which is significantly different to the ABS. Year on year the increase is 7.1% which is also significantly different to the ABS. If anybody can explain the big difference I would be very interested to know.

Also looking at Logan City the quarter reveals increases of 3.5% while year on year increases have been 7%.

Wednesday 3 February 2010

UK Mortgage Approvals – February 2010 Update

On Saturday I discussed why I might have been early in my call that we had potentially reached the ‘Return to “normal”’ phase of the UK house market. I would like to revisit this again as I continue seeing data that is potentially starting to point towards a further housing market correction.

The first chart is a repeat of that shown on Saturday. I described how the new interest rates secured on dwellings are still very low at 4.5% compared to the peak of 6.3% and have likely had a big effect on the market. What is of interest however is that this 4.5% increase is 7% more than the low of June 2009 and is trending in an upwards direction with no assistance from the Bank of England.

The second chart today also shows another interesting piece of data. The olive line is the most interesting which shows seasonally adjusted monthly mortgage approvals decreasing for the first time in 13 months dropping from 60,045 to 59,023 in December which is a decrease of 2%.

Rising mortgage interest rates will put pressure on those who have variable rates or are coming off fixed rates. It will also decrease the level of borrowing possible for a new person trying to enter the housing market. Additionally falling mortgage approvals suggests less competition in the market for each house that is for sale.

Could the rules of supply and demand finally start to work in the near future?

Monday 1 February 2010

Australian Property Market – February 2010 Update

I intend to keep a close eye on Australian house prices as I build my retirement portfolio. This is because Australia is a very likely retirement possibility (if not sooner) for me.

I intend to keep a close eye on Australian house prices as I build my retirement portfolio. This is because Australia is a very likely retirement possibility (if not sooner) for me.The first chart shows the quarterly Real (adjusted for the Consumer Price Index) Brisbane and Real (again adjusted for CPI) Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index with data taken from the Australian Bureau of Statistics catalogue 6416.0 since 1991. This Index was reset in 2003/2004 and so I have “corrected” pre March 2002 data by taking the ratio’s of the pre and post September 2003 to June 2004 data as a multiplier. This chart carries data only until December 2010 and clearly shows a nice dip at the start of 2009 before the latest data point has taken house prices to new record real highs.

My second chart shows Real Annual Changes in price from 1995 to present. In Real terms over this period Brisbane has seen average increases of 5.3% (up from an average of 5.2% last quarter) and the Australian Eight Cities has seen average increases of 4.9% (up from an average of 4.8% last quarter). Unfortunately for me though the trend lines (particularly for Brisbane) continue to head upwards.

In non-inflation adjusted terms over the period Brisbane prices have seen average increases of 8.1% and the Australian Eight Cities prices have seen average increases of 7.8% (up from an average 7.6% last quarter). Unfortunately if you don’t already own a property you continue to be priced out when compared with average earnings. Using the Australian Bureau of Statistics catalogue 6302.0 (extrapolating the last quarter as the data is not released to the 25 February) which looks at average weekly earnings shows that while house prices have had their long run averages increase this quarter, Total Weekly Earnings have stagnated at a yearly 3.8% and Total Full Time Adult Earnings at 4.3%.

My third chart shows what happens when house prices continue to rise at a rate greater than salaries. Over this period affordability of Brisbane houses when compared to Adult Full Time Weekly Earnings has gone from a low of 0.063 to 0.121 meaning affordability has halved and the Median Eight Cities houses have gone from a low of 0.064 to 0.112 which is a huge reduction. This type of shift is just not sustainable but when/if will the market return to a more sustainable equilibrium.

Looking at the big increases this quarter I can’t help wonder if the data is ‘reliable’ and I would like to see how the histograms have changed since 2008. This is because the government has brought forward demand and changed the dynamic in the market by offering first home buyer grants with changing values depending on the date. If I had have bought before 14 October 2008 I would have received $7,000. Using this as a 5% deposit would mean I could borrow $140,000. If I had have bought a new house between 14 October 2008 and 30 September 2009 I would have received $21,000 which again with a 5% deposit would mean I could borrow $420,000. That has to change the supply and demand dynamic in the market. This ‘stimulus’ has now been gradually withdrawn with first new home buyers being reduced to $14,000 between 01 October 2009 to 31 December 2009. Finally, since 01 January 2010 first home buyers are back to $7,000 meaning we’re back to that $140,000.

So if I was a first home buyer I would have bought between October and September with first home buyer stragglers buying also in October to December. I would now be out of the market. I think the Housing Industry Association (HIA) may have seen in this when they reported that new home sales are down 4.6% in December 2009.

It will be very interesting to see what happens next. Australia has rising interest rates and if supply and demand works (assuming no government intervention) second home buyers may now struggle to sell without reducing prices as their pool of buyers has been reduced, along with the pool that remains having smaller deposits. This should reduce prices going forward. This should then flow through the rest of the market. Interesting times ahead...

Subscribe to:

Posts (Atom)