I couldn’t have asked for a better start to 2017. From a Mediterranean home research perspective we spent some time on the Costa del Sol exploring from just east of Marbella through to Gibraltar. We viewed possible homes, walked/ran on the beach, soaked up some sunshine and also took a few days to put some charge back in the batteries in readiness for the final push from FI to FIRE.

All I can say about this part of Spain is that I could very happily grow old in this part of the world. The final fight between this part of Spain and Cyprus really is on but to be honest I expect I’ll be very happy in either location. I just feel so fortunate that this is now possible and is really about to happen.

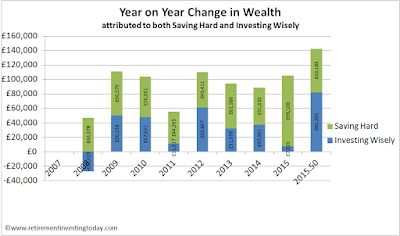

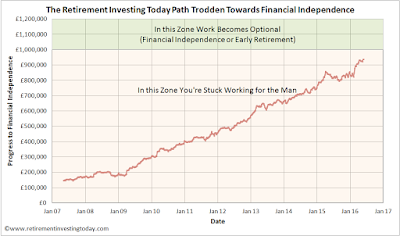

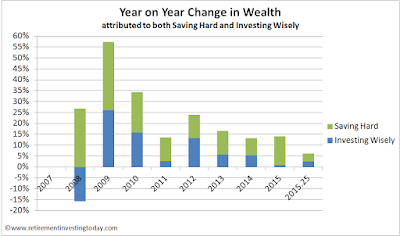

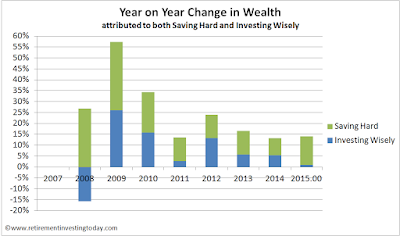

On the financial side of things the world is also good with savings and investment returns putting more icing on the cake by adding another £75,800 to my wealth. Let’s look at this in a little more detail.

Saving Hard score: Conceeded Pass. I can’t give myself a pass as I’ve missed the target but when I’ve saved £51,800 (admittedly including a very healthy bonus) and only spent £6,500 I’m also not going to beat myself up about it too much.

All I can say about this part of Spain is that I could very happily grow old in this part of the world. The final fight between this part of Spain and Cyprus really is on but to be honest I expect I’ll be very happy in either location. I just feel so fortunate that this is now possible and is really about to happen.

Click to enlarge, The view from one of the properties within our budget

On the financial side of things the world is also good with savings and investment returns putting more icing on the cake by adding another £75,800 to my wealth. Let’s look at this in a little more detail.

SAVE HARD

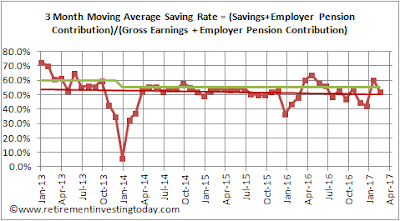

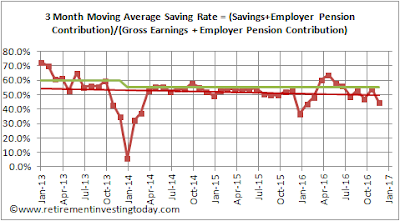

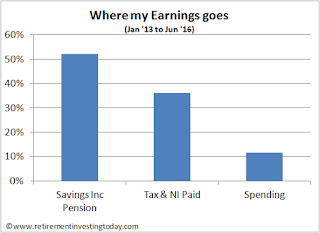

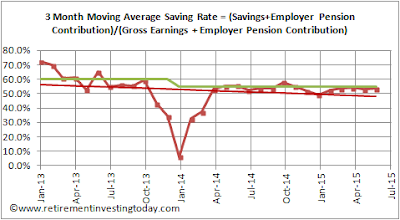

I unapologetically continue to define Saving Hard differently than most personal finance bloggers. For me it’s Gross Earnings (ie before taxes, a crucial difference) plus Employer Pension Contributions minus Spending minus Taxes. Earn more and one is winning. Spend less or pay less taxes and you’re also winning. Savings Rate is then Saving Hard divided by Gross Earnings plus Employer Pension Contributions. To make it a little more conservative Taxes include any taxes on investments but Earnings include no investment returns. This encourages me to continually look for the most tax efficient investment methods. I finished the quarter with a reasonably healthy Savings Rate of 52.2% against a plan of 55.0%.

Click to enlarge, RIT Savings Rate

Saving Hard score: Conceeded Pass. I can’t give myself a pass as I’ve missed the target but when I’ve saved £51,800 (admittedly including a very healthy bonus) and only spent £6,500 I’m also not going to beat myself up about it too much.