As an employee of a company I have the option to contribute to a pension scheme. I have made the choice as part of my retirement investing strategy to contribute to the pension scheme as the company matches my contributions up to a limit, plus as I salary sacrifice into the pension, they also generously contribute the 12.8% employers national insurance that they would have otherwise paid to HMRC. I will complete a blog on pensions hopefully in the near future.

This is new money that enters every month and is currently the equivalent of about 0.5% of my total retirement investing assets. Another months worth of contribution has just been made. This is currently automated to occur each month and will be invested as follows:

- 4% to Index Linked Gilts. This adds up to be a very small contribution but I want to just keep nibbling a little.

- 60% to UK Commercial Property. A big contribution is made here as my desired low charge portfolio requires 10% asset allocation and my current low charge portfolio is only at 8.1%.

- 21% to International Equities. My desired low charge portfolio currently requires 13.3% asset allocation and my current low charge portfolio is only at 13.1%. This is the only input to International Equities that I am currently exploiting.

- 15% to UK Equities. This is one that requires a little explaining. My desired UK Equities is 18.6% and my current UK Equities is 18.6% so I am where I need to be. Where I am underweight heavily is Emerging Markets Equities by 2.3% and my total Equities exposure is also underweight by 2% at 54%. In an ideal world I would be buying Emerging Markets however my company based pension is inflexible (like a lot of company based schemes I would guess) and the lowest cost Emerging Markets Equity fund that I can buy has fees of 2%. Now I refuse to pay anyone 2% in fees and so the compromise I have made is to try and bolster my Equities allocation while acknowledging I am underweight Emerging Markets. Not ideal I know but fits with strategy to minimise fees.

As always DYOR.

Thursday 11 February 2010

Wednesday 10 February 2010

UK House Price Thoughts

As part of my retirement investing strategy at some point I need to buy a house. As I have mentioned before I am not currently buying as I believe house prices are overvalued.

As part of my retirement investing strategy at some point I need to buy a house. As I have mentioned before I am not currently buying as I believe house prices are overvalued.I have been looking for a data set that would show me when average interest rates charged by the banks for house mortgages were starting to rise. I was also looking for a measure that would show increases fairly quickly rather than waiting for lots of old fixed rate mortgages to expire. I thought I had found a good measure and started to see rates rising by using UK resident banks interest rates of new loans secured on dwellings to households when I blogged here.

I’ve been thinking about what loans secured on dwellings means and it seems likely that it includes a lot more than mortgages. I’ve had another trawl through the Bank of England web site and found a data set that should be certainly showing very recent changes to mortgage interest rates and might be more appropriate to use. This data set is the monthly interest rate of UK resident banks and building societies sterling standard variable rate mortgage to households not seasonally adjusted (data set IUMTLMV). A chart of this is shown above. Unfortunately, unlike the previous ‘secured on dwellings’ data set variable rates are still at lows of around 4% having been as high as 8.87%. So unfortunately for those (including me) waiting for increasing mortgage rates to potentially reduce house affordability it appears we have a while to wait yet.

On a more positive note it’s not all good news for house prices. Firstly, as reported by the Financial Times lenders “have warned that they will have to slash mortgage lending and raise rates on home loans if the government insists on prompt and full repayment of the £300 billion they have received in state support since 2008”. This is linked to the Special Liquidity Scheme and the Credit Guarantee Scheme which must be repaid by 2012 and 2014. So the banks are back to big profits and big bonuses yet they can’t give the government back the money they have borrowed. That money is my taxes we are talking about. If they can pay bonuses they should be repaying their loans like everyone else. The article goes on to say that the “lenders cannot retain their existing loan books and still make new ones while access to wholesale funds is as limited as it is” and continues with “retail deposits, which are considered far more stable and which bank regulators are encouraging lenders to rely on more heavily as a source of funds for new lending, simply cannot grow quickly enough to make up for the wholesale funds that are being withdrawn.”

Here’s an out of the box idea. How about the government lets the market operate freely rather than distort it with all this intervention. So where do the banks then get their money from? Another ‘crazy’ idea. How about they start paying interest rates on savings that are above inflation and that will encourage people to start saving again. Oh that’s right, that would then force mortgages up and maybe bring house prices back to more sensible levels. Let’s see if the government after the next election gives in to the banks demands.

Secondly, the Financial Times also reports that estate agents have seen the first drop in new buyer enquiries for 14 months. Is this a genuine fall or due to the cold weather that we have been happening? I guess it will all show up in the house price figures in due course.

As always DYOR

Tuesday 9 February 2010

My Current Low Charge Portfolio – February 2010

Buying (New money): As always I contributed about 60% of my gross salary towards my retirement investing strategy. Since my last post the allocations I have made are 100% Cash.

Buying (New money): As always I contributed about 60% of my gross salary towards my retirement investing strategy. Since my last post the allocations I have made are 100% Cash.Asset Movements: As I detailed here I also moved about 0.6% of my total retirement investing assets from cash to commodities (gold).

Selling: Nothing this month

Dividends: Australian Equites paid dividends equal to 1.6% of the total value of my Australian Equities. These dividends were moved to cash.

Current UK Retail Prices Index: 2.9%

Current Annual Charges: 0.59%

Current Expected Annual Return after Inflation: 4.1%

Current Return Year To Date (from 01 January 2010): -2.8%

How close am I to retirement: 39.7% down from 41.3%. Retirement can move further or closer each month and is affected by movements in asset allocations, asset prices or additions/withdrawals to my current low charge portfolio.

The following are the highlights for the month:

- Desired Cash portion moves from 12.4% to 11.5%. This month I have moved further from the desired by going from 13.5% to 14.0%.

- Desired Bonds portion doesn’t move from 17.4%. This month I have moved further from the desired by going from 20.1% to 20.8%.

- Desired Property stays constant at 10.0%. This month I have moved closer to the desired by going from 7.9% to 8.1%.

- Desired Commodities stays constant at 5.0%. This month I have moved closer to the desired by going from 2.6% to 3.2% with the gold purchase.

- Desired International Equity portion moves from 12.9% to 13.3%. This month I have moved further from the desired by going from 13.3% to 13.1%.

- Desired Emerging Market Equities stays constant at 5.0%. This month I have moved further from the desired by going from 2.9% to 2.7%.

- Desired Australian Equity portion stays moves from 19.3% to 19.2%. This month I have moved closer to the desired by going from 20.5% to 19.5%. As I mentioned above dividends helped me to remove some assets from here.

- Desired UK Equity portion moves from 18.0% to 18.6%. This month I am right on the desired by going from 19.3% to 18.6%.

Monday 8 February 2010

Australian Property Market (Alternate Data) – February 2010 Update

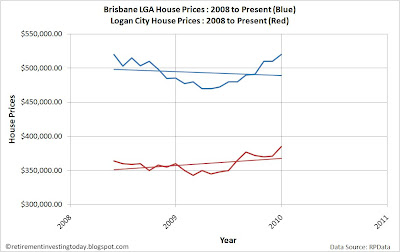

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.

The Brisbane and Australian Eight Cities (Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin & Canberra) House Price Index published by the Australian Bureau of Statistics (ABS) catalogue 6416.0 suits my requirement to track Australian house prices as part of my retirement investing strategy. It however seems to have two flaws. Firstly the housing data is only published quarterly and secondly this housing data is then published over a month after the quarter ends.I’m therefore looking for something that helps me keep my finger on the pulse a little more. Certainly monthly figures are desirable. I am going to therefore use housing data published by RPData and in particular I will monitor the Brisbane and Logan City numbers.

The ABS published their quarterly data to December 2009 on Monday. This chance only comes every 3 months and so it is interesting to compare the ABS data with the alternate monthly dataset that I am using from RPData which is shown in the above chart. The ABS shows that for the quarter to December 2009 Brisbane prices have risen by 3.8% with a year on year increase of 10.9%. Remember the ABS reports median prices for detached properties only.

In contrast from RPData I am using what are called recent median house sale prices so I would expect similar data. For Brisbane the data shows increases for the quarter to December 2009 of 5.9% which is significantly different to the ABS. Year on year the increase is 7.1% which is also significantly different to the ABS. If anybody can explain the big difference I would be very interested to know.

Also looking at Logan City the quarter reveals increases of 3.5% while year on year increases have been 7%.

Sunday 7 February 2010

Free Asset Allocator Website

I am running my entire retirement investing strategy including expected annual returns and projected retirement dates from an excel spreadsheet. Today though, I stumbled upon a nice little tool that looks to be written by Morningstar which provides a quick way of mixing up simple asset allocations to project expected returns. Additionally if you enter the portfolio value, annual investments, desired years to retirement or similar and your total financial goal it provides a probability of reaching the goal. Link here.

I am running my entire retirement investing strategy including expected annual returns and projected retirement dates from an excel spreadsheet. Today though, I stumbled upon a nice little tool that looks to be written by Morningstar which provides a quick way of mixing up simple asset allocations to project expected returns. Additionally if you enter the portfolio value, annual investments, desired years to retirement or similar and your total financial goal it provides a probability of reaching the goal. Link here.The website states “Asset Allocator helps you assess the likelihood of meeting your financial goals based on your current financial situation. If you find that you are not on track to meet your goals you can adjust certain criteria and immediately see the effect of your portfolio's growth potential.”

I entered my retirement investing strategy into the site which included a Portfolio Value which is currently at 40% of my Financial Goal. My Annual Investments were based on me investing around 60% of my gross annual earnings and I entered my time to retirement (Years) as 7 years. Asset Mix was entered as my Desired Low Charge Portfolio as I describe regularly on the site including here.

The Expected Return was provided as 8.99% with a 3 year standard deviation of 13.18. An Expected Return of 8.99% seems a little bullish for my tastes. Using my models I have a current expected annual return after inflation of 4.2%. The UK arithmetic mean of the retail prices index (RPI) since 1987 is 3.5%. Totally these would give an expected return of around 7.7% before inflation which is a variation of 1.29%.

What is also provided by the website is a Probability of [reaching my] Goal. In my case this was provided as 91%. I’ll take those odds...

As always DYOR.

Subscribe to:

Posts (Atom)